This article will review:

General FAQs

Who do I contact for help?

Email support@serviceminder.com. One team handles it all.

What are the fees and rates for serviceminder|pay?

serviceminder|pay uses transparent, flat-rate pricing. Credit card transactions cost 2.99% of the amount (no per-transaction fixed charge), and ACH (bank draft or e-check) transactions cost 0.75%. There is an optional accelerated settlement plan at $0.50/transaction fee. There are no monthly gateway fees, no setup fees, and no minimum processing requirements.

How fast are deposits?

Typically, next business day. ACH may take 1-2 days.

What are the funding timelines?

-

Standard Funding (T+2): Batches closed by 9:30 p.m. ET, funds deposited two business days after transaction.

-

ACH Timeline: ACH payments settle T+2 (e.g., transactions on Monday before 9:30 p.m. ET → funds received Wednesday).

Who is Forward and Plaid in relation to serviceminderpay?

Forward is the processor and payments partner. Plaid is the bank account linking tool used to ensure secure ACH transactions and compliance.

Is there a contract or long-term commitment?

No. There is no long-term contract for serviceminder|pay. It’s a pay-as-you-go service with no penalties for starting or stopping.

Can I pass fees to my customer?

Yes! Enable compliant credit card surcharging via Control Panel > Payments.

How long does it take to switch to serviceminder|pay?

The sign-up application takes less than 15 minutes, with same-day approval in most cases. If additional info is needed, approval may take a couple of business days.

Do I need to re-enter customer credit card information when I switch?

No, serviceminder|pay supports token transfers to import stored payment data securely.

What happens to my historical payment data from my old processor?

Past payments from your old processor will remain in its reporting system, but new payments will be recorded in serviceminder|pay.

Will my customers notice any changes during the switch?

No, your customers will not experience any disruption. They will still click the same “Pay” button on invoices or proposals, and the payment experience remains the same.

Can I switch some locations to serviceminder|pay and have others stay on the old processor?

Yes, you can migrate locations on your own schedule. Consolidating on one platform simplifies support and reporting.

Does our franchisor or corporate office need to be involved in onboarding?

No, the serviceminder|pay team handles onboarding directly with each franchisee.

Is serviceminder|pay secure and PCI compliant?

Yes, serviceminder|pay adheres to PCI DSS standards, encrypting and tokenizing all card data to ensure maximum security.

Does serviceminder|pay support recurring billing and stored payment methods?

Yes, recurring payment features and stored payment methods are fully supported.

What if my serviceminder|pay application is flagged by underwriting?

If flagged, approval may take a few days for additional review. You may temporarily have a processing limit or funds held until approval.

Does serviceminder|pay integrate with QuickBooks Online for accounting?

Yes, the integration works seamlessly, with payments processed through serviceminder|pay syncing directly to QuickBooks.

Are there any changes to how I issue refunds or do voids?

No major changes, though refunds and voids are now processed directly through serviceminder|pay.

Can I still pass on convenience fees or use service fee features?

Yes, your existing settings for service fees, surcharges, or convenience fees will remain available, with the exception of surcharging being capped at 2.99%.

What if I need help or have questions during onboarding?

You can reach the serviceminder support team via email at support@serviceminder.com or submit a support ticket. Assistance via calls is available if needed.

What user permissions are related to SM Pay?

- Pay:Account gives the user full access to Pay-related settings and functionality

- Pay:Reporting grants access only to the Pay reporting and documentation links - not account information

Chargeback FAQs

What is a chargeback?

A chargeback occurs when a customer is reimbursed for a debit or credit card charge after successfully disputing it with their bank, rather than the business that charged them.

How will I know if I get a chargeback?

You’ll be notified by email with a deadline to submit documentation. Our support team will help to relieve the burden from you.

Who initiates the chargeback?

The chargeback process can be initiated by either the cardholder or the cardholder’s issuing bank. The issuer or cardholder requests a credit, refund, or reimbursement, claiming an incorrect or invalid transaction. A financial institution can initiate a chargeback to reverse a credit card payment for Card Not Present (CNP) transactions (meaning the cardholder does not physically present their card at the business’s point of sale).

How do I know I have received a chargeback?

ServiceMinder will email the chargeback information to the location contact immediately upon receiving notification that there is a new dispute case that needs addressing. The documentation will have information about the dispute that will help identify the specific case being submitted.

What is the chargeback process?

When a chargeback is initiated, the issuing bank forwards the dispute to the Card Brand (Visa, MasterCard, Discover, or Amex), which then sends it to the Acquirer/Processor that processed the transaction. The Acquirer/Processor will check the validity of the dispute and forward it to ServiceMinder. If the merchant challenges the dispute with supporting documents, the Acquirer sends it back to the Card Brands who pass it on to the Issuing Bank. If the Issuing Bank accepts the documents, the merchant is credited. If not, the dispute can continue with other stages like arbitrations.

What do I do when I receive a chargeback?

Submit all transaction records, receipts, shipping information, and any other relevant documentation to ServiceMinder to provide evidence that the transaction was legitimate and that the cardholder’s claim is unfounded. In cases other than fraud, you may be able to resolve the issue directly with the customer.

How long do I have to respond to a chargeback?

You have 10 days to respond to the chargeback from the original chargeback date. Federal law requires card issuers to offer chargebacks within 60 days of the date of billing.

What happens if I do not respond to a chargeback?

If you do not respond, the chargeback will eventually move to the Closed work queue, and the Acquirer may pursue the case on your behalf on a “best effort” basis.

What is the cost of receiving a chargeback?

There is a $30 fee for each chargeback occurrence.

What is a Retrieval Request?

A Retrieval Request is a request for proof that a transaction was valid. No financial adjustments are made for Retrieval Requests, but if you do not respond, you could be held responsible for any chargeback cases that result.

Glossary of Terms(i.e. Payments Translation)

| Term | Definition |

|---|---|

| ACH (Automated Clearing House) | An electronic network for processing bank-to-bank payments (e.g., eChecks). ACH payments in serviceminder|pay let customers pay directly from their bank account with lower fees (0.75%). These typically take a couple of days to clear, and serviceminder|pay speeds up funding compared to traditional ACH processors. |

| Chargeback | A transaction reversal initiated when a customer disputes a charge with their bank. In a chargeback, the amount is withdrawn from the merchant and returned to the customer unless the merchant successfully challenges it. Businesses have a set time (10 days for serviceminder|pay) to respond with evidence. Too many chargebacks can hurt a business, so serviceminder|pay assists in managing them. |

| Chargeback Fee | A fee charged to the merchant to cover the cost of processing a chargeback dispute. serviceminder|pay’s chargeback fee is $30 per occurrence. This fee is standard and only applies when a chargeback happens (it’s not charged for regular transactions). |

| EIN (Employer Identification Number) | A unique ID number issued by the IRS to identify a business. It’s like a social security number for your company. serviceminder|pay requires your EIN on the application to verify your business identity for underwriting and tax purposes. |

| Encryption | The process of converting sensitive data (like credit card numbers) into a secure code to prevent unauthorized access. serviceminder|pay uses encryption for all transactions– meaning data is scrambled during transmission and storage. Only authorized systems can decrypt and read it, keeping information safe from hackers. |

| Forward | The processor and payments partner powering serviceminder|pay. |

| PCI DSS (Payment Card Industry Data Security Standard) |

A set of security standards all businesses that handle credit cards must follow. Being PCI compliant means serviceminder|pay meets strict requirements for protecting card data (firewalls, encryption, regular security scans, etc.). This reduces the risk of data breaches. With serviceminder|pay, you automatically benefit from our PCI compliance – there’s no separate PCI certification fee or questionnaire for you to fill out. |

| Plaid | The bank account linking tool used to remove the need for manual data entry of banking information, and allow secure checks to ensure ACH transactions have reduced returns and are NACHA compliant. |

| Tokenization | A security technology that replaces sensitive data (like a card number) with a non-sensitive “token” – a randomly generated string of characters. serviceminder|pay and serviceminder use tokenization for stored payment methods. For example, when a customer’s card is saved, the actual card number is stored securely by the processor, and serviceminder only keeps a token. If you switch processors, a token transfer moves these tokens to the new system so the cards don’t need to be re-entered. Tokenization greatly reduces risk because a stolen token is useless without the secure token vault. |

| Underwriting | In payments, underwriting is the process of vetting a merchant’s business for risk before allowing them to process payments. This may include credit checks, verifying business details, and ensuring the business type is acceptable. Most serviceminder|pay applications are approved instantly, but if your account is flagged for underwriting it means the processor is doing additional checks. Once you provide any needed info and they approve, you’re good to go. It’s similar to how getting a loan approved works, but much quicker for payment accounts. |

| Merchant Account | A type of bank account that allows a business to accept credit card payments. serviceminder|pay essentially creates a merchant account for you under the hood, which is why you go through an application. The merchant account is where funds from sales are held briefly before being deposited to your business bank account. Traditional merchant accounts were separate from software, but with serviceminder|pay, it’s integrated into serviceminder, making setup and management easier. |

| Payment Gateway | The technology that captures and transfers payment data from the point of sale (like serviceminder’s payment form) to the payment processor. In the past, you might have used gateways like Authorize.net or others. serviceminder|pay is built-in, so you don’t have to set up an external gateway – serviceminder acts as the gateway, securely sending transactions to the processor. This reduces points of failure and simplifies support. |

Guide to Using the Forward Merchant Portal

How to Access your Merchant Portal

- Receive Approval & Onboarding

Once your application is approved and your business is boarded to serviceminder Pay, you’ll receive confirmation that your merchant account is active. - Portal Login

Go to https://portal.getfwd.com/- Use your login credentials provided during boarding.

- If you have trouble logging in, use the "Forgot Password" link or contact support.

Benefits of Using your Forward Reporting Dashboard

- Real-time visibility into payments processed for your business and transactional reconciliation, especially for those operating with two gateways at once until the full migration is complete.

- Understand total payments volume, refunds, disputes, and payouts in one place.

- Review fees charged on each transaction, helping you reconcile costs.

- Identify trends to improve cash flow forecasting.

Using this tool ensures you’re always informed about what’s happening with your transactions and payouts, before these reporting features are built into your serviceminder platform.

How to Navigate the Forward Portal

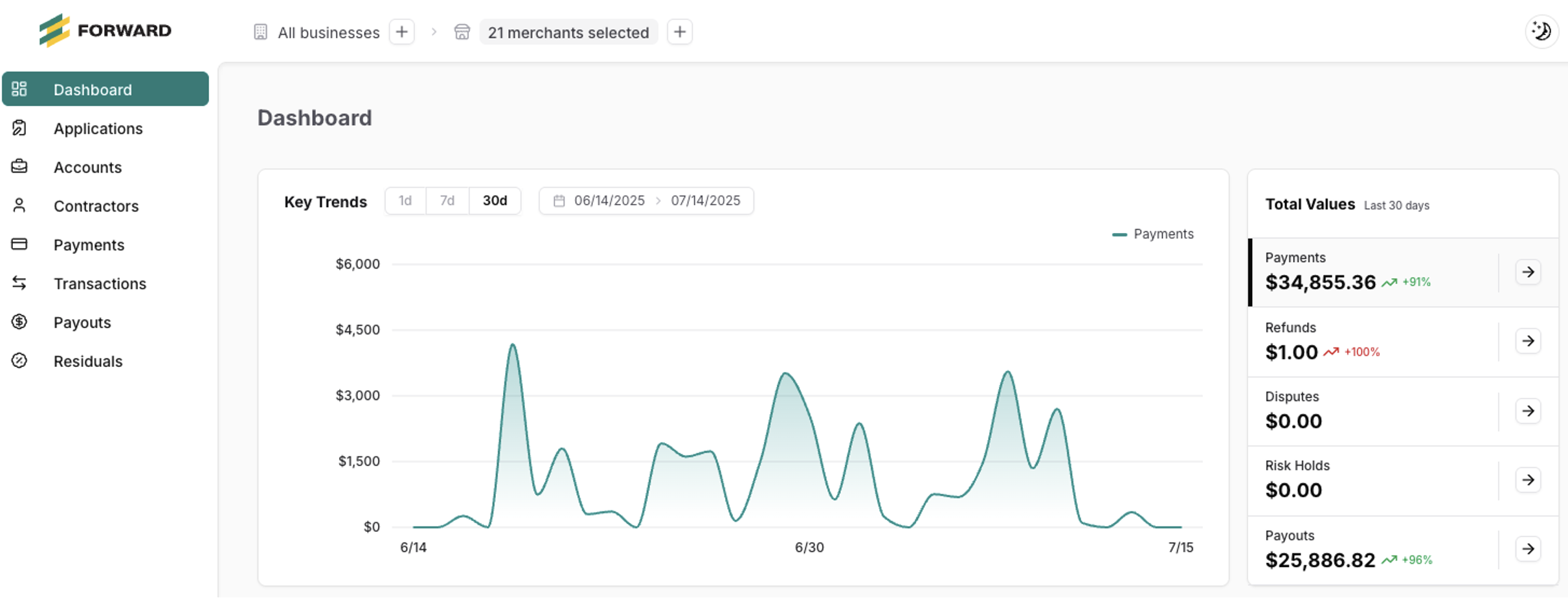

1. Dashboard Overview

- Key Trends graph shows payment volume over time (last 30 days shown here).

- Side panel totals show:

- Payments processed

- Refunds issued

- Disputes (chargebacks)

- Risk holds

- Payouts settled to your bank

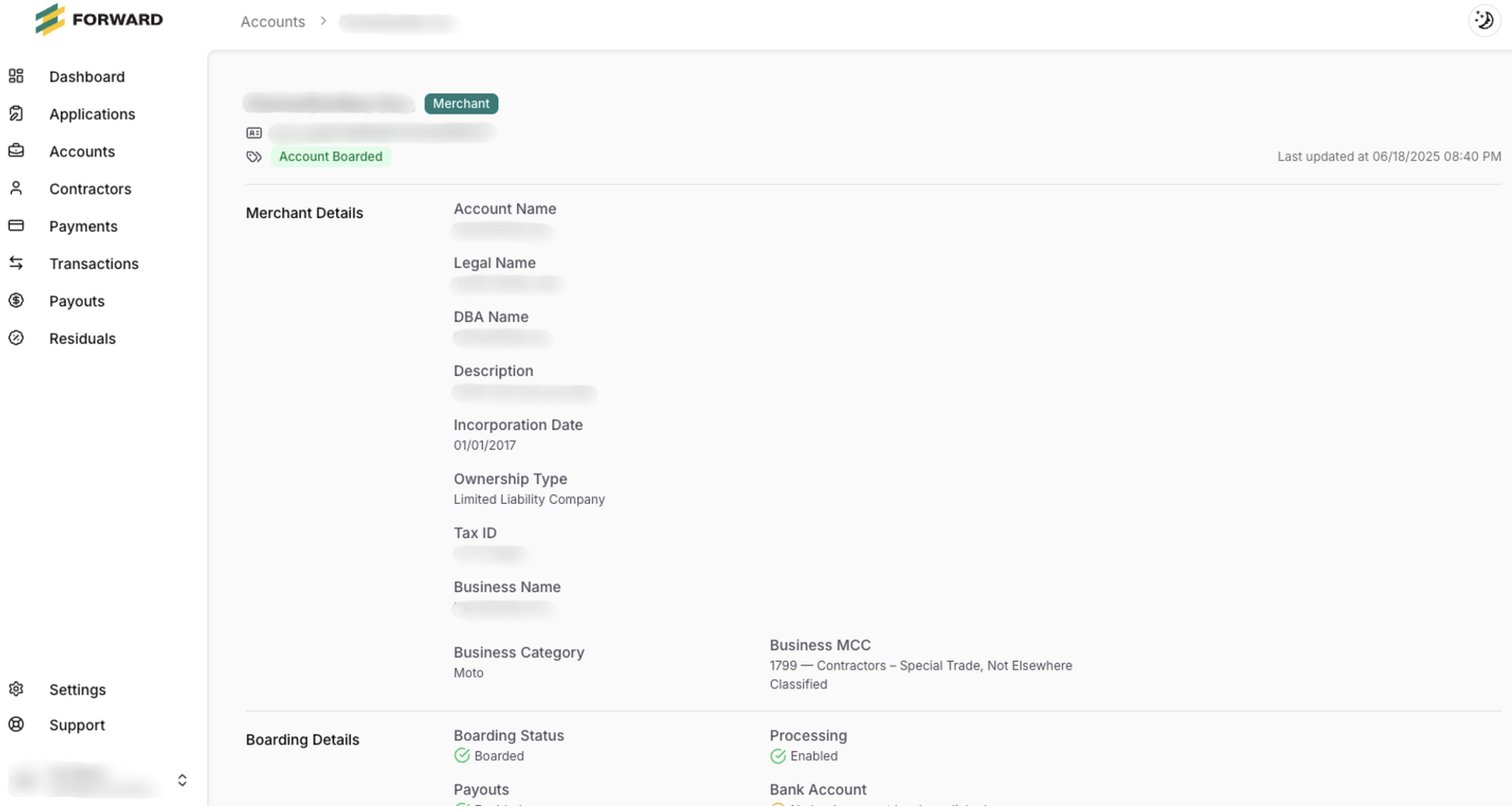

2. Accounts

- View details on your merchant account:

- Business name, DBA, incorporation, and MCC (Merchant Category Code).

- See if processing and payouts are enabled.

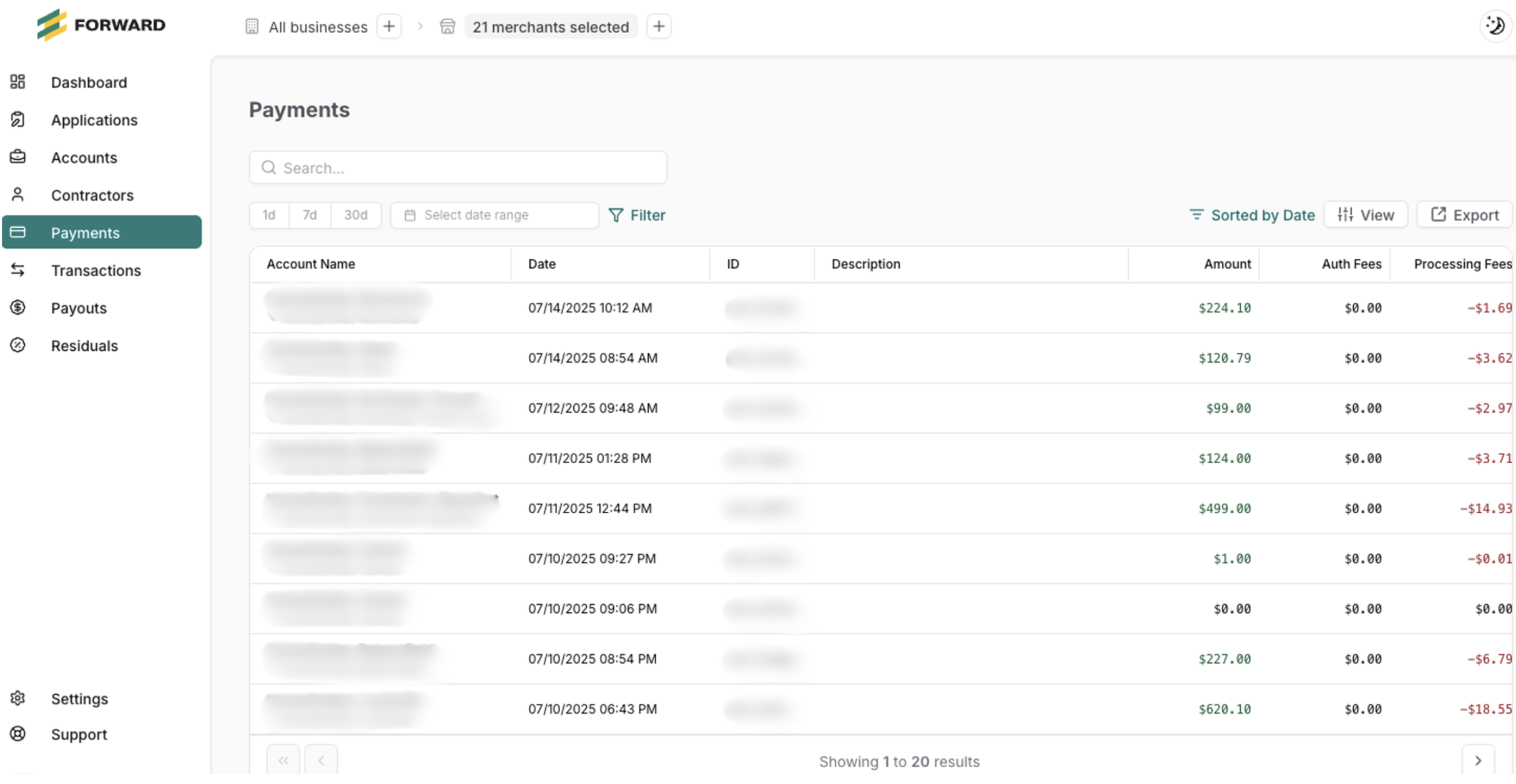

3. Payments

- Use this view when you want to see individual payments that were collected

- View each transaction with processing fees and the net deposit amount

4. Transactions

- Use this view as a ledger to see every payment and fee individually

- Filter by date or search by type (payment or fee).

- Helps you reconcile transactions and see card fees or auth fees applied.

4. Payouts

- Use this view to reconcile what made up each bank deposit

- Shows when money is paid out to your bank account.

- All activity impacting a payout will be clearly detailed so you can reconcile the amount with your bank deposit

5. Merchant Profile

- See legal business details, incorporation, tax info, and category.

- Useful for audits or record keeping.

How to Use your Downloaded Reports

You can export transactions and payouts from the portal to CSV to do custom analysis.

For example:

- Compare amounts processed vs payouts received.

- Verify the effective fees on payments.

- Tie back individual transactions to your invoices or service jobs.

Glossary of Common Column Headers

Column |

Meaning |

ID |

Unique identifier for transaction/payment/fee. |

Tenant / Partner / Business ID |

Internal platform IDs (Forward, serviceminder) |

Account Name |

Your business name as boarded. |

Source Type |

Payment vs Fee vs Refund vs Adjustment. |

Amount |

Gross amount processed. |

Settlement Status |

settled means funds cleared. |

Payout Status |

Indicates if tied to a payout batch. |

Payout ID |

The batch payout identifier. |

Description |

Card fee %, auth fee or general payment. |

Date |

When transaction occurred. |

Created At |

When payment was first created (in payments file). |

Amount Captured |

Amount finalized on the card. |

Amount Authorized |

Amount originally authorized. |

Amount Refunded |

Any portion refunded. |

Amount Disputed |

Amount tied up in a chargeback. |

Tips & Common FAQs

- ✅ Reconcile daily or weekly: Check the portal regularly so you catch any issues early.

- 🔍 Use filters: Filter by date or type (Payment/Fee) to zero in on specific data.

- 📂 Export often: Save local copies of reports for your own accounting records.

- 🛠 Questions about fees? Look at Description in the transactions table or exported CSV — it breaks down card fees vs auth fees.

- ⚠️ If you see disputes or chargebacks: Contact Forward or your implementation team immediately.