Overview

If your business would like to offer a Gift Card or Gift Certificate to customers, there are two ways you can accomplish this in serviceminder:

- Create a Part that holds a discounted value

- Apply a Credit Memo to the customer's profile or to a specific invoice

If you’d like to measure the impact for marketing or reporting, using the Part method is especially helpful. You can run the Part Summary Report to see how often these items are used, who’s using them, and in what context. This article will explain how to use a Part that applies a discount as a Gift Card.

To learn more about how to use Credit Memos, visit our Credit Memos and Write Offs article.

This article will review:

Creating a Part

To get started, create a new Part called Gift Certificate, Gift Card, or something similar:

-

Go to Control Panel > Parts > Add.

-

Set the Unit Price as a negative value of your Gift Card.

-

If you only ever sell $50 gift cards, set the Unit Price to -50.

If you want to be able to change the price of the Gift Card, set the Unit Price to $0. You'll be able to set a unique value on each proposal or invoice.

-

-

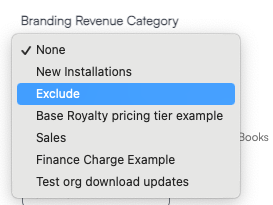

If applicable, be sure to select Exclude in the Branding Reporting Category for this Part.

Adding to a Proposal

When someone purchases and/or redeems a gift certificate:

-

Create a Proposal for the customer. If they’re buying a certificate, make sure the Proposal requires a 100% deposit, then generate the invoice from it.

-

Add a note to the invoice making it clear it’s a gift certificate, and add a note to the Contact’s profile that they have a credit (include the invoice number for easy reference).

-

Add the Gift Certificate Part to the Proposal.

-

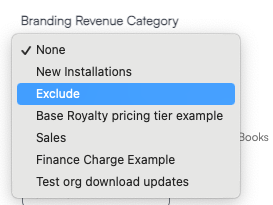

If the Part has a $0 amount, you can enter a negative dollar value in the Rate field or type the discount percentage into the Quantity field.

-

Once you hit Enter, the Amount will update to a negative value and the balance due will adjust accordingly.

Reporting

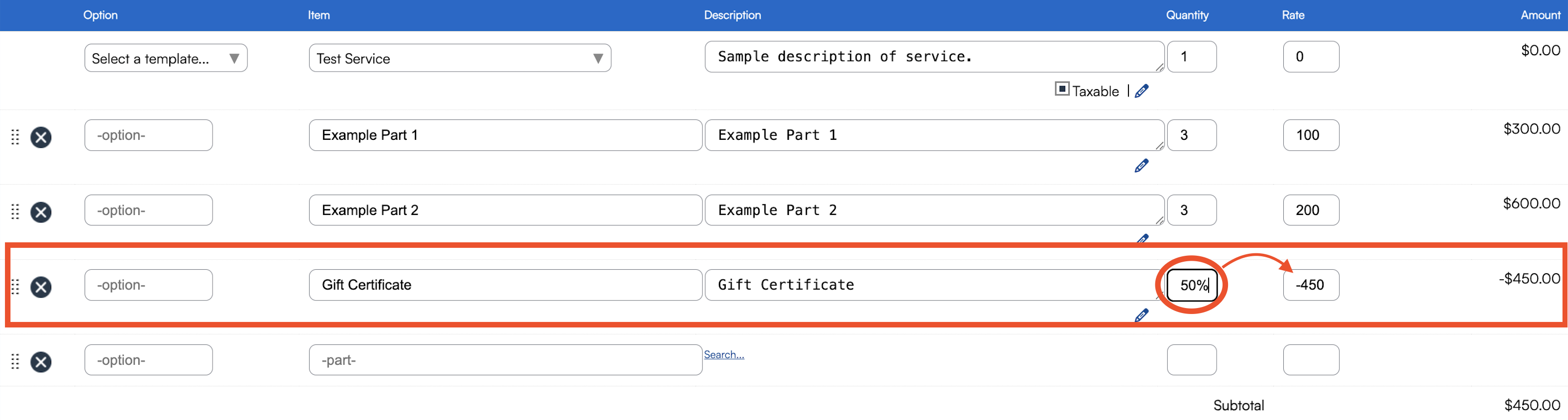

Want to see how often gift cards, certificates, or discounts are being used? Run the Part Summary Report. This gives you a quick look at usage trends and helps with marketing or financial reporting.

In the top right corner, you can use the dropdown menu and choose to organize the report in the following ways:

- Service Agent

- Part

- Contact

- Owner

- Organization

FAQs

What if the discount is more than the total job cost?

You don’t need to track that manually. Once the invoice is paid, you can create a credit memo for the overpayment. That memo will track the remaining balance and let you apply it to future invoices.

When making a payment that exceeds the invoice balance, you can check the box for Apply Excess to Other Invoices to carry the credit forward automatically to any other unpaid invoices.

How do I apply a 20% discount on a proposal?

For percentage discounts, create a Part with a $0 Unit Price, then enter the percentage in the Quantity field of the Proposal.

- For fixed-dollar discounts, you can create a Part with a negative Unit Price (e.g.,

-10for $10 off). - For percentages, you’ll always set the value directly on the Proposal, since the Unit Price field only accepts dollar amounts. Set the value by typing the percentage of discount directly into the Quantity field for that part on the proposal.