Overview

ServiceMinder provides End of Period (EOP) reporting to calculate royalties and fees. Depending on your brand’s configuration, the report runs on either a weekly (EOW) or monthly (EOM) basis, as determined in your Franchise Disclosure Document (FDD).

- EOM and EOW are the same report, just with different date ranges.

- Both are sometimes referred to as End of Period (EOP) in ServiceMinder fields and downloads.

- The report provides franchisors with an aggregated view of brand performance while also helping franchisees avoid “surprise” royalty calculations.

Key points:

- Report contents depend on the brand’s royalties and revenue category settings.

- Franchisees only see their own reports (never other locations).

- Reports can be submitted by the franchisee or auto-submitted by the franchisor (recommended).

- To maintain data integrity, invoices/proposals cannot be backdated or edited after submission when reporting in Accrual mode.

This article will review:

Settings and Navigation

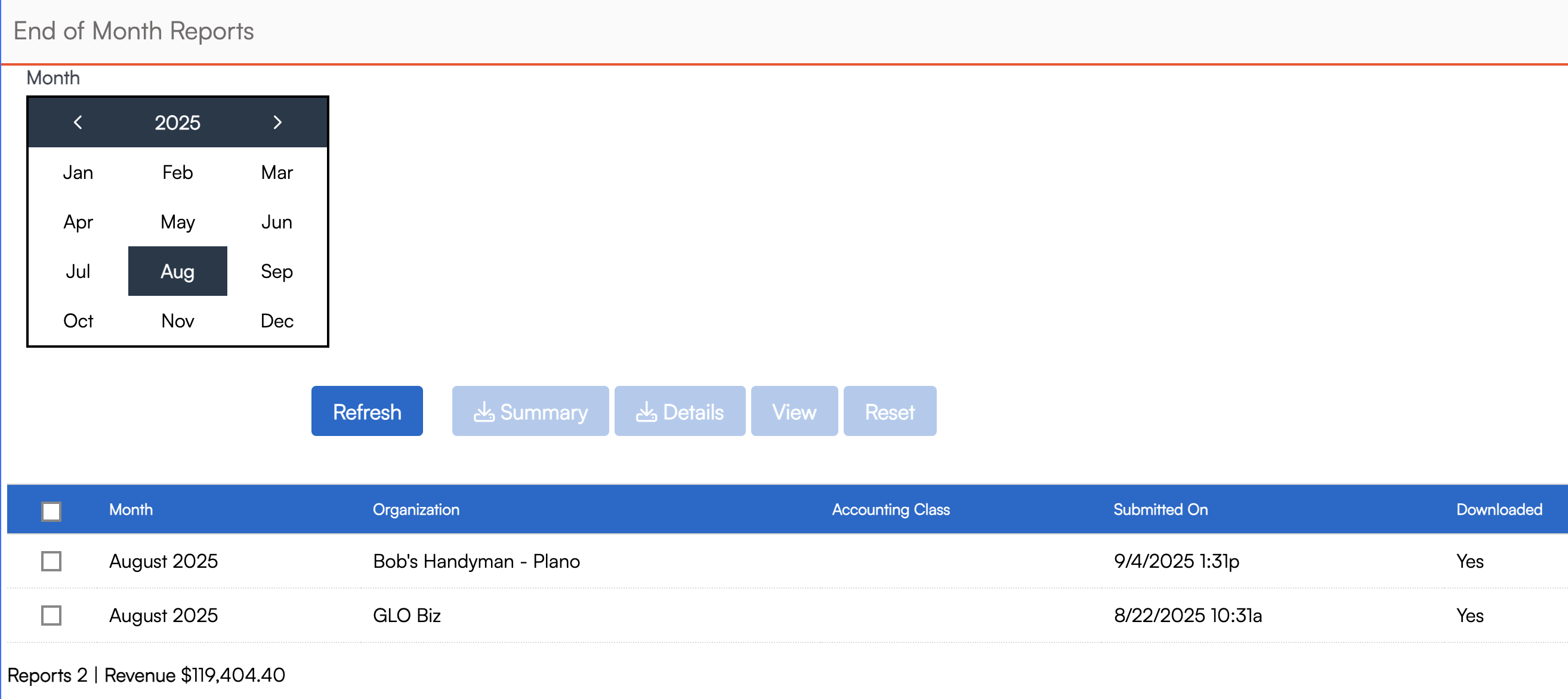

Franchisors (Brand Administrators) can access End of Period reports via Dashboard > Reports > End of Month.

From here you can perform the following actions:

- Select Year/Month – View which locations have submitted reports.

- Distinct vs Aggregate – Choose whether to view territories separately (distinct) or combined (aggregate).

- Refresh – Reset to current month.

- Summary – Download a high-level revenue and royalty/fee spreadsheet.

- Details – Download basic revenue data for the period.

- View – Access a full report with Revenue, Proposals, and Leads & Marketing.

- Reset – Un-submit a report, sending it back to the franchisee for corrections.

Reporting Mode Settings

There are two places where you configure how royalties are reported and collected.

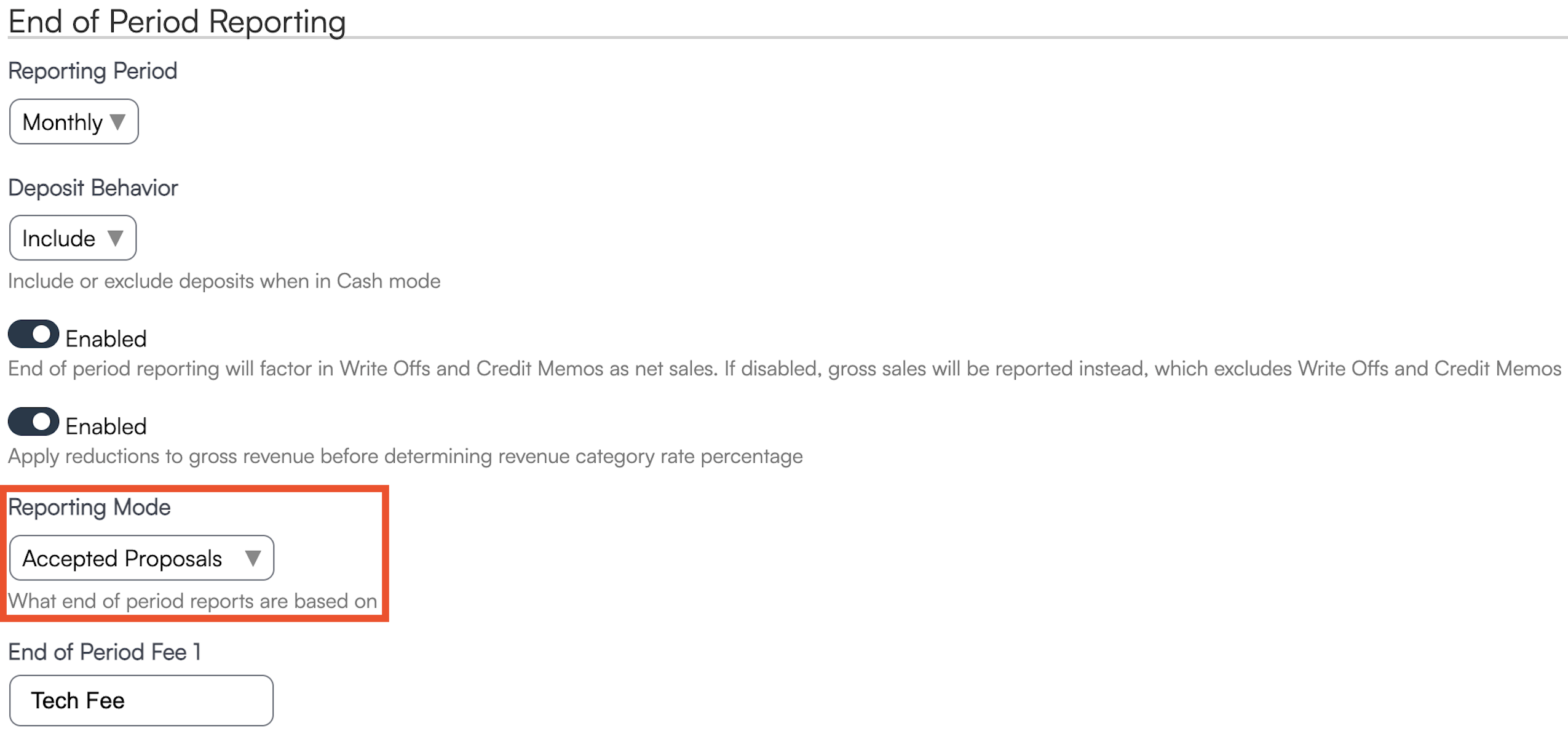

Brand Reporting Mode

In Dashboard > Tools > Configuration you can edit the brand reporting mode. This reporting mode controls which document (invoice or proposal) the dollar value is pulled from for royalties.

- Invoices: Collects royalties based on what was invoiced during that period.

- Accepted Proposals: Collects royalties based on what accepted proposed value during that period.

- Completed Proposals: Collects royalties based on what completed proposed value during that period.

- This setting is also impacted by an organization's Proposal Completion Mode.

- Appointments Completed: The proposal will have a "Complete" status when all connected appointments are completed.

- Invoiced: The proposal will have a "Complete" status when it has been 100% invoiced.

- Invoiced or Appointments Completed: The proposal will have a "Complete" status for whichever comes first - either the proposal is 100% invoiced or all connected appointments are completed.

- Paid: The proposal will have a "Complete" status when it has been 100% paid.

- This setting is also impacted by an organization's Proposal Completion Mode.

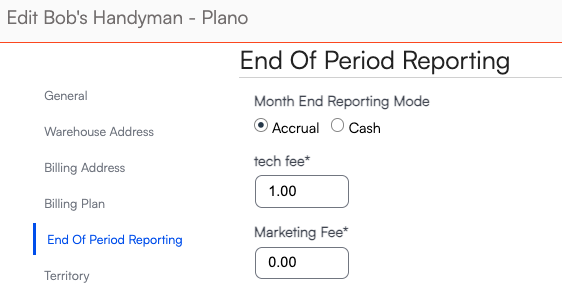

Organization Reporting Mode

In Dashboard >Tools > Organizations you can edit an organization and adjust their reporting mode as well as any end of period fees you may have set up. This reporting mode controls at what point in the transaction the money is collected.

- Cash: Royalties are collected on payments that are collected in that period.

- Accrual: Royalties are collected on proposed revenue for that period.

How Organization and Brand Reporting Modes Work Together

| Org Reporting Mode | Invoices | Accepted Proposals* | Completed Proposals |

|---|---|---|---|

| Cash | Royalties are based on payments collected during the reporting period that were applied to invoices (even if invoices were created earlier). | Royalties are based on the total value of proposals accepted during the reporting period, regardless of payment. | Royalties are based on payments collected on proposals marked “Complete” during the reporting period (per Proposal Completion Mode). |

| Accrual | Royalties are based on the total invoice values created during the reporting period, regardless of payment status. | Royalties are based on the total value of proposals accepted during the reporting period, regardless of payment. | Royalties are based on the total proposed value of proposals marked “Complete” during the reporting period, regardless of payment (per Proposal Completion Mode). |

*Accepted Proposals mode will disregard Cash vs Accrual settings.

Reminders and Auto Submit

To reduce manual follow-up, franchisors can automate reminders and submissions.

- Submission Reminder: Sends an automatic email prompting franchisees to review and submit reports.

- Auto-Submit: Locks reports on the chosen date and auto-submits them at midnight.

- You can enable reminders with or without auto-submit.

Example:

- You want monthly reports finalized by the 10th.

- Set Auto-Submit On = 9th

- Set Due Date = 10th

- Enable reminder to send 5 days before due date

The reminder comes from the serviceminder back end. It is "hard-coded" so there is no verbiage for a Brand Admin to edit.

Excluding from End of Period Reports

You also have the ability exclude certain things from being reported for your End of Week/End of Month calculations.

Excluding Organizations

If you have a sandbox or training organization that you don't want to see reports on, there is a way to turn off tracking so it doesn't get mixed in with live business data.

- Go to Dashboard > Tools > Organizations

- Click Edit next to the location

- Under Territory, check Exclude from Reports

Excluding Invoices

Some types of business may require longer periods between when an invoice is created or billed and when it is considered paid or completed. Possibly you have to deal with insurance, which can take months or you have a special case where a project has stalled. This will require Brand Administrator approval.

For cases such as stalled projects or delayed insurance payments:

- Open the invoice

- Click Settings > Exclude from End of Month Report

Notes:

- Excluded invoices will not appear historically in past reports — only in current/future periods if re-included.

- If left excluded, royalties will never be charged.

Tracking Excluded Invoices

In the organization, go to Reports > Downloads > Invoice Downloads.

There is a column labeled Excluded in EOP. As a reminder, EOP refers to End of Period.

Under the Exclude from EOP column header, you see a Y/N listed. If it is excluded, that will be a Yes.

If previously excluded and you uncheck the box for the invoice, then download the invoices once again this will show differently.

If the invoice is included again, that changes to a "No". In the Reporting Date column, a date will show.

FAQs

What’s the difference between Cash and Accrual for End of Period reporting?

This setting determines when revenue is recognized.

- Cash: Based on payments received. Invoices appear on the End of Period report when payments are applied. If deposits are included in your “Deposit Behavior” settings, they will carry over and appear as payments when the invoice is generated.

- Accrual: Based on invoices or proposals created. Invoices appear on the report when they are generated, regardless of payment or deposit dates.

What does the "Date" column refer to on the End of Period reporting?

The date column is the Invoice Creation date.

What date should I use for Auto-Submit if I want reports on the last of each month?

Enter 31 as the Auto-Submit date. The system automatically treats 31 as the last day of the month, even for months with fewer days, so your report will auto-submit on the final day.

How do I allow a user to exclude items from the end of month report?

Excluding from the End of Month report is a user permission.

1: Go to the User profile.

2: Click Edit.

3: Select the Permissions Tab.

4: Grant the permission Invoices:ExcludeFromEndOfPeriod.

Which payments or invoices are filtered out of the End of Month report?

For reporting mode: Invoices

- Net Sales (On): Includes Write-Offs and Credit Memos as net sales.

- Credit Memos provide credits customers can use toward future invoices.

- Write-Offs represent balances you don’t expect to collect.

- Apply Reductions Before Rate (On): Reductions are applied to gross revenue before royalty rate percentages are calculated.

Are refunds are included in the End of Period report?

Depending on the brand's FDD and royalty settings, refunds may or may not be included in royalty calculations.

- If the brand set up Net w/ Accrual mode: Write Offs and Credit Memos are included.

- Refunds are excluded inherently as a part of accrual mode because accrual is reporting on invoice subtotals (not payments on invoices).

A location's EOM report didn't auto-submit. What settings should I check?

Go to Dashboard > Organizations > Edit Org and make sure that Exclude from Reports checkbox is unchecked.

A location’s EOM tax column is showing zero. Should they set a default tax rate or add taxes manually?

They can do either, but the best practice is to:

- Set a default tax rate.

- Apply tax rates to existing contacts.

- Go to Control Panel > Invoices > Manage Tax Rates, Mapping to verify rates from QBO and map any missing ones.

- Click Save and Update All to apply rates to customers.

- Ensure all Services and Parts that should be taxed are marked “Taxable.”

Taxes will then calculate automatically on new invoices. You can also edit existing invoices to add a tax rate if needed.

Why do I see discrepancies between the End of Period report and the Proposal Summary and/or Invoice Summary reports?

The End of Period report takes some additional configurations into consideration since it is the report used to namely calculate revenue as it relates to what royalties will be collected off of.

If you have Net Sales disabled (Dashboard > Configuration), gross sales are being reported on the EOM/EOW report, which excludes Write Offs and Credit Memos. Both Proposal Summary and Invoice Summary reports include write-offs or credit memos.

If an invoice has already been reported on the End of Month and the franchisee wants to add Interest and Fees at a later date, what is the best practice on handling these going forward?

If the invoice was already reported in the EOM report and your royalties are based on Invoices, creating a new invoice for fees/interest would be the right call to keep the accounting accurate.

What happens if a franchisee tries to backdate an invoice?

Franchisees cannot create invoices dated in prior months.

- In Accrual Mode, they’ll see an alert instructing them to contact their brand administrator.

- In Cash Mode, they’ll be prevented from creating a payment for a prior period.

What’s the difference between the End of Period report and the Proposal Summary report?

- Proposal Summary: Includes all proposals marked Completed, Invoiced, Scheduled, or Accepted—regardless of when they were created. For example, proposals created in February could appear if they changed status in March.

- End of Period (EoP): Includes only proposals created during that month and tracks how many were won.

In short: Proposal Summary looks at proposal status changes; EoP looks at proposals created within the reporting month and their outcomes.