Overview

Setting up sales tax in serviceminder can be accomplished in four simple steps! Review the process on this page so you can seamlessly apply taxes to your proposals and invoices.

Please confirm with a CPA or your local tax office regarding the sales tax requirements for your city and state.

This article will review:

Setting Up Your Tax Rates

Properly configuring your tax rates in ServiceMinder ensures accurate invoicing and smooth syncing with QuickBooks, if integrated. Follow the steps below to set up your tax structure correctly.

1. Sync Your First Invoice (If you are integrated with QuickBooks)

Before your QuickBooks tax rates can appear in ServiceMinder, at least one invoice must sync from ServiceMinder to QuickBooks. This triggers QuickBooks to share tax rate data with our system.

-

Create an invoice with a value of at least $1.

-

This invoice can be a real transaction or a test invoice.

-

-

Once the invoice has synced, your QuickBooks tax rates will appear below the native ServiceMinder tax rates in the tax rate settings page.

Important: Set up your tax rate structure in QuickBooks before syncing. ServiceMinder will not push rates to QuickBooks—only retrieve what’s already there.

2. Create Your Tax Rates in ServiceMinder

Navigate to Control Panel > Invoices > Manage Tax Rates, then click Add.

If you're integrated with QuickBooks:

-

Use the dropdown to link each ServiceMinder tax rate to the corresponding QuickBooks tax rate.

-

Name the tax rate similarly to its QuickBooks counterpart to keep them easily identifiable.

-

Enter the full combined rate (state + local). The percentage must match the QuickBooks rate for successful syncing.

-

Item Name and Agency Name are optional fields to support you with your bookkeeping.

-

Item Name: The Sales Tax Item name in Quickbooks

-

Agency Name: The entity (typically a government body) to which you remit collected taxes

-

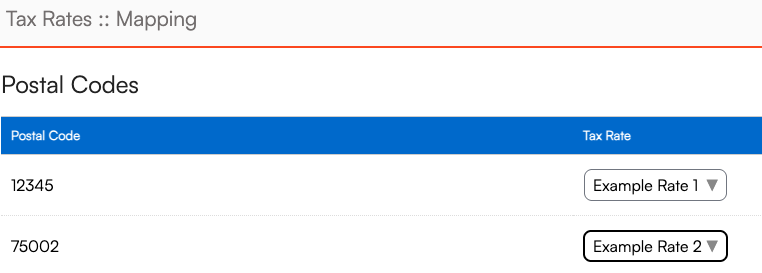

3. Map Tax Rates to Geographic Zones

After your tax rates are created, click the Mapping button in the top right corner of the tax rates page.

This allows you to assign tax rates to geographic regions based on your jurisdiction’s requirements—state, county, city, or postal code.

-

Use the dropdown menus to apply the correct rate to each zone.

-

When finished, click either:

-

Save and Update All Contacts – applies rates to all contacts based on their address.

-

Save and Apply to Unmapped Contacts – only applies rates to contacts without an existing tax rate assigned.

-

Save - does not update contacts.

-

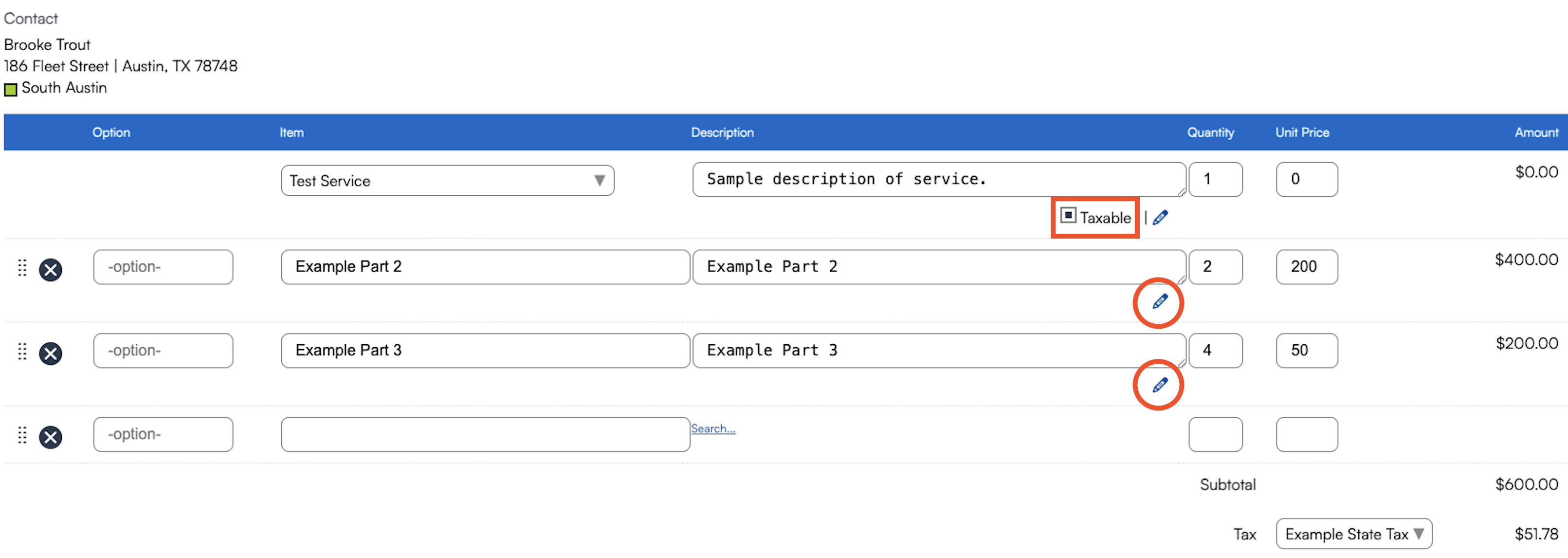

4. Mark Taxable Services and Parts/Add-Ons

Services act as the main switch for whether line items on proposals and invoices are taxable. If the service line is not marked as taxable on a proposal or invoice, the entire transaction will not be taxed.

To mark a service as taxable:

Go to Control Panel > Services, edit the service, scroll to the Duration and Pricing section, and check the Taxable box. Save your changes.

If you cannot charge tax on the value of the service line and you need to tax certain parts/line items, it is recommended to:

- Change the price of the service to $0.

- Create a part that can hold the dollar value of the service (this can be named identically to the service or something else that makes sense for you).

- Mark the part as not taxable and the service as taxable.

To mark parts as taxable:

Navigate to Control Panel > Parts/Add-Ons and edit individual parts to check the Taxable box.

Need to update multiple parts at once?

- Filter the Parts grid to show only the items you want to change.

-

Click Actions > Update, then set the Taxable option for the selected items.

Retroactive Updates to Proposals and Invoices

Existing proposals and invoices will not update automatically. To apply tax to them:

-

View the proposal or invoice details page.

-

For services, the Taxable checkbox is directly visible—simply check it.

-

For parts, click the pencil icon next to the line item, then check the Taxable box in the pop-up window.

Tax Finder

Do you live in an area that uses incredibly complex tax codes? Does your state map taxes by the individual address? Then you will likely need to use Tax Finder feature. Tax Finder can be found in the Marketplace. It will automatically map your tax rates for you and can look up tax rates for each individual contact.

With Tax Finder, you get 100 lookups per month. It will look up your contact when they are imported into the system and automatically update their tax rates if their address is changed in the system as long as you use the search bar when entering the contact's address. The tax rates are automatically named and mapped for you.

This feature is an additional charge. To learn more about Tax Finder and add it to your account, please visit our Marketplace.

FAQs

Why isn't tax applying on my proposal/invoice?

If the tax is not applying correctly, please review these three questions. If the answer is No to any of those questions, please review the steps above on this help page to make the necessary adjustments.

- Are my taxes set up in Control Panel >Invoice > Manage Tax Rates?

- Is the correct tax rate mapped to this contact?

- Is the Taxable box checked for the Service and relevant Parts on my individual invoice?

Why aren't my tax rates from QuickBooks showing up?

Ensure the following to make sure your QuickBooks tax rates sync over properly:

- Make sure your QuickBooks integration is Active in Control Panel > Integrations > Accounting

- Review your tax rates in QuickBooks. The need to be Active and have a valid percentage in order to populate in serviceminder.

- Sync at least one invoice (it can be a "dummy" $1 invoice that is then voided) from serviceminder over to QuickBooks.

When mapping my tax rates, do I need to select a rate for all items within each of the categories (i.e., postal codes, cities, counties, and states?

This depends on how your taxes are set in your area. If you only have state tax, you can set that and be done. If you have tax rates set up by county, you'll map your rates to their corresponding counties. If your taxes rates vary by more than one category or even by individual address, Tax Finder might be the right fit for you.

Do Service settings override Part settings in regards to taxes?

Services are the main On/Off switch for Taxes. If Parts are On but Services are Off, taxes will not be collected on that invoice.If you are a franchisee, your brand's deploy account, the Services will all default to having the taxable box unchecked. Each location will need to check it on depending on their local tax laws. This way, it doesn't default to on and owners don't charge taxes if they don't need to.

Are taxes included in my royalties reporting (End of Week/End of Month)?

Within the End of Week/End of Month report, you may see a column which tells you the taxes charged per that reporting period but these are NOT included in the royalties that are due. The system automatically doesn't apply royalties to taxes.

Should I be seeing all of our territory Postal Codes and mapping them? I only see 2 of them but I should have way more.

This will update as invoices are created for additional areas. Right now, you may not have contacts in all territories within your serviceminder contact list. It will only show zips, cities, etc. of existing contacts.