Overview

As a franchisor, you need to ensure that you collect the royalties and fees due from your franchisees in accordance with your Franchise Disclosure Document (FDD).

ServiceMinder offers a robust set of settings and configurations to make reporting and tracking royalties easy for any franchise organization. It’s very important to set this up correctly!

Order of Dominance for Royalty Calculations

- Accounting Class (overrides everything else)

- Organization

- Brand Dashboard Revenue Categories

This article will review:

Step 1: Determine Your Strategy

Before getting started, we recommend answering the following questions for your brand:

1. Do your franchisees report weekly or monthly?

- If weekly, then when does your week start and end?

2. At what stage to they report on revenues for royalty reporting?

- Invoices

- Completed Proposals

- Accepted Proposals

- Do you collect on Net or Gross Sales?

- Accrual or Cash basis?

- Accrual-based: Invoices appear on the End of Period report as soon as they are created. The franchisee is charged for the full cost of the job that will be billed to the customer.

- Cash-based: The franchisee pays royalties on the money collected. A deposit on a proposal may appear on a different End of Period report than the final payment, but the franchisee is only charged once for each payment received.

3. Will your services be under separate revenue categories, or will they all "roll up" into a "Sales" category?

4. Do you want the report to auto-send? If so, which day should they be submitted?

Step 2: Set Up End of Period Reporting

Go to Dashboard > Tools > Configuration Settings, then scroll down to the End of Period section.

Choose your settings based on your brand reporting structure and FDD requirements.

See additional information about End of Month/Week Reporting

Step 3: Configure Revenue Categories

Go to Dashboard > Tools > Revenue Categories.

This is where your brand defines royalty settings such as minimums, maximums, variable percentages, and tiered royalties.

These brand-level settings can be overridden at the Organization or Accounting Class levels.

Click Add to create a new category and configure the following settings (Name and Default Percentage are required):

| Setting | Description |

|---|---|

| Name | How you will identify this Revenue Category. |

| Group By | Categories with the same Group will be grouped into a single line when downloading your branding's end of period report. |

| Apply to Total Sales* | If enabled, this category will apply to the total of all sales across all services instead of only services within this category. |

| Exclude from Minimum | If you set a minimum amount of royalties to collect, royalties from this category will not contribute to that minimum. |

| Exclude from Total | Royalties from this category will not contribute to the total collected. |

| Annual Accumulation | Treat this category as a rolling total for the year. |

| Active | Check this box to make this category active and useable. |

| Default Percentage | What percentage of the invoice will be charged this royalty? |

| Per Invoice | Apply a flat royalty amount in this category per invoice. |

| Minimum | Minimum royalty amount to apply. |

| Maximum | Maximum royalty amount to apply. |

| Maximum Period | Time period in which the maximum is calculated before resetting. |

*Apply to Total Sales - Only select this if you’re creating an item not tied to a service (e.g., a brand Marketing Fund percentage). If checked, this category won’t be available for individual services.

Royalties Exclusions

Exclude from Minimum

A minimum royalty ensures a franchisee pays at least a base amount (e.g., $450/month). If a category is excluded from the minimum, royalties are only calculated using the percentage rate for that category (e.g., 6%), with no guaranteed minimum.

Exclude from Total

This completely removes this category from royalty calculations. For example, Disaster Relief Services might be excluded since they represent community service rather than revenue.

Rate Pricing Bands

After saving the category, click Edit to reveal rate band options.

If your royalty schedule has nuances, like minimums and "layers" of calculations, here's an example using the settings in the example above with a minimum royalty of $2,000.

At Least |

Less Than |

Base Royalty |

Percentage |

|---|---|---|---|

| 0 | $30,000 | N/A | 7% |

| $30,000 | $60,000 | N/A | 6% |

| $60,000 | $120,000 | $3,900 | 5% |

| $120,000 | N/A | $6,900 | 4% |

In this example, the following franchisees would owe these amounts:

Franchisee Earned |

Royalties Owed |

How It's Calculated |

|---|---|---|

$20,000 |

$2,000 |

The minimum ($2,000) is greater than 7% of $20,000 ($1,400). |

$40,000 |

$2,700 |

7% of the first $30,000 ($2,100) + 6% of the next $10,000 ($600). |

$75,000 |

$4,650 |

The Base Royalty ($3,900) + 5% of the next $15,000 ($750). |

$150,000 |

$8,100 | The Base Royalty ($6,900) + 4% of the next $30,000 ($1,200). |

Update Services

Your Revenue Categories tie directly to your services. This not only enables detailed performance reporting but also allows you to collect different royalty amounts based on the service.

Once categories are set up, go to Control Panel > Services, then edit each service by scrolling down to the Invoicing section.

Step 4: Override Brand Royalty Settings

It’s common for franchise systems to evolve their FDD over time. For example:

- Early franchisees may have a flat fee royalty program.

- Newer franchisees may operate under a variable royalty.

- A single owner might manage multiple territories, each with different royalty structures.

Even if most franchisees are under an older agreement, we recommend ensuring that brand-level royalty settings match the current FDD.

To adjust for exceptions:

-

Go to Dashboard > Organizations.

-

Click the organization name (do not click Edit).

-

Under the Additional Details section, select the Revenue Category Rates tab and edit as needed.

Do not use the Royalties tab for this task. It shows calculated royalties but does not contain settings.

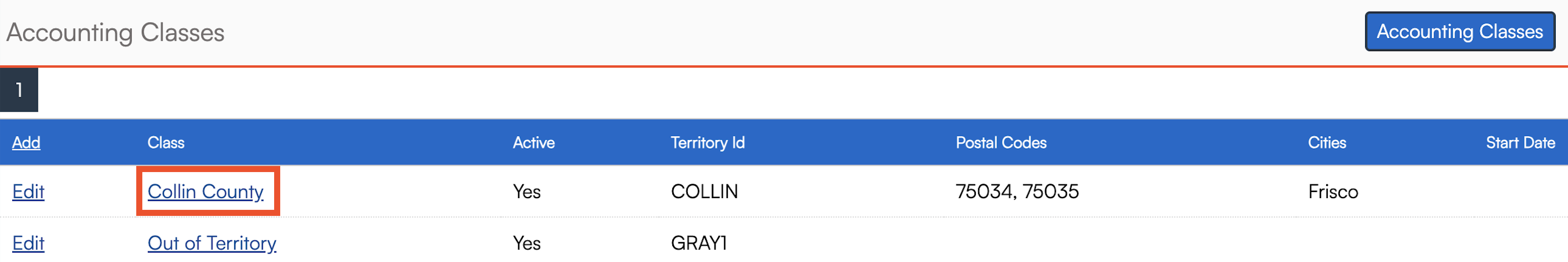

If one franchise owner manages multiple territories with different agreements, override the brand settings at the Accounting Class level:

-

While working directly in that organization, go to Control Panel > Integrations > Accounting and click Manage under Accounting Classes.

-

Click the name of the Accounting Class/Territory (not Edit).

-

Open the Revenue Category Rates tab and adjust rates as needed.

-

Click Save when finished.

Invoices with Finance Charges

Organizations can configure finance charges in Control Panel > Invoices, including percentage, message, and automation settings.

What This Means for Franchisors

Ask yourself:

- Do you collect royalties on finance charge revenue?

- Are your royalties based on accrual or cash?

If you do collect royalties on finance charges under an accrual model, you’ll need to run a Parts Usage Report on the finance charge part to capture those charges if the invoice was already submitted for royalties.

If you don’t collect royalties on finance charges, create a Brand Revenue Category for them with a 0% rate.

FAQs

Q: If a franchisee invoices a customer in March for $100, pays royalties, and then writes off the invoice in April, will that affect April royalties?

A: Yes. If based on Net Sales, the $100 write-off will reduce the April royalty amount.

Q: Which invoices are locked once the End of Period report is submitted?

A: If royalties are based on invoices created (Net Sales), the report shows all approved invoices from that month. Voided invoices are excluded. Write-offs appear on the report but are not included in royalty calculations.

Q: What’s the difference between basing royalties on proposals vs. invoices?

A: If royalties are Cash/Invoice-based, deposits on proposals are not considered revenue until invoiced and paid.

Q: Are there different reports for accrual vs. cash-based royalties?

A: Most reporting is accrual-based and consistent across all brands. If your royalties are cash-based, use these reports:

- Org level: Payment Reconciliation or End of Period

- Brand level: Payments by Accounting Class and End of Period

Q: Why do I see refunds on my End of Week/Month report? Am I charged royalties on them?

A: No. Refunds appear in parentheses (e.g., ($25.00)) to indicate subtraction from total royalties.

Q: Are taxes included in royalties?

A: No. Taxes may appear in reports for reference, but royalties are not charged on taxes.

Q: What should I do if my report seems incorrect?

A: Contact your Brand Admin or Business Coach. They can submit a support ticket to ServiceMinder for review.

Q: What happens if deposits are excluded from End of Period reporting?

A: The intent of excluding deposits is that once the invoice is paid, the entire amount will appear on the End of Period report.