Overview

ACH payment processing refers to the electronic transfer of money between bank accounts via the Automated Clearing House (ACH) network. It's a secure and efficient way to move funds, commonly used for direct deposits, bill payments, and other types of electronic transactions

Electronic checks (eChecks) work similarly to paper checks. When a payment is submitted, the bank may take several days to verify that funds are available. Merchant processors can also vary in the time it takes to process and deposit ACH payments.

This article will review:

Settings and Navigation

To configure ACH/eCheck payments:

Go to Control Panel > Integrations > Payments.

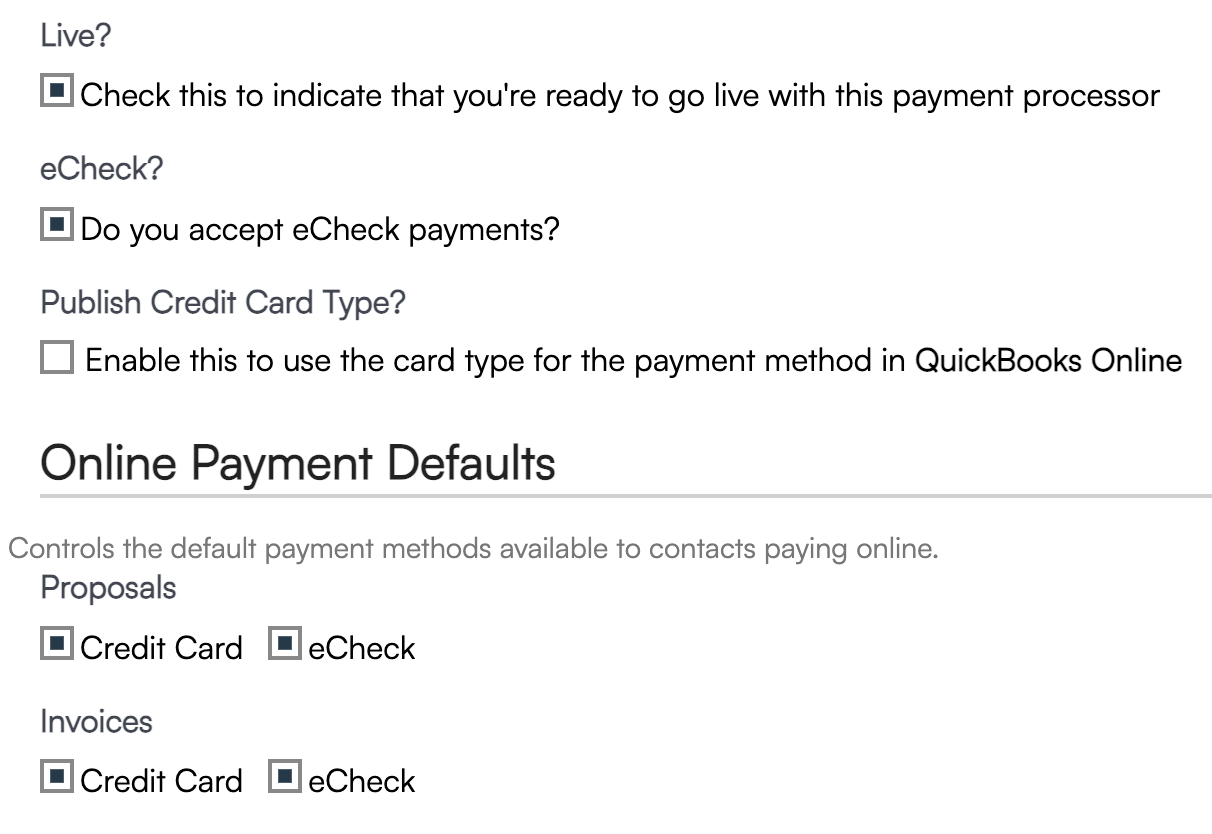

Under Payment Gateway, you can enable the ability to accept eCheck (ACH) payments.

Note: Only enable eCheck if your merchant processor supports it. Some processors require additional forms to set up ACH processing alongside credit card processing. Check with your provider to confirm.

How eCheck (ACH) Works

ACH payments are processed through the Automated Clearing House (ACH) network, a secure system that moves funds between banks electronically.

Here’s how an eCheck transaction flows:

Customer provides bank information – routing number and account number.

Transaction is initiated – a request to debit the customer’s account is sent to your processor.

Transactions are batched – the processor collects transactions and submits them in batches to the ACH network at the end of each business day.

Bank processes payment – the customer’s bank verifies the account and either approves or returns the transaction.

Funds are deposited – if approved, funds are transferred to your business account via electronic funds transfer (EFT).

This process usually takes two to three (2-3) business days, though some banks support same-day or next-day processing. The funds are transferred from the customer’s bank and deposited into your business bank account.

ACH Returns/Declines

ACH payments are not instant. Unlike credit card transactions, approval does not guarantee immediate payment. Returns or declines may occur days later.

Key points:

Returns happen when a transaction cannot be completed, such as insufficient funds (NSF).

Declines are issued by the customer’s bank.

ServiceMinder records these events for accounting purposes. You can mark a transaction as “refunded” without sending anything to the customer’s bank.

A "refund" is needed for these transactions in serviceminder to reflect that these funds were essentially never received so there is no issue with accounting and also royalty payments.

- Issue the refund in ServiceMinder.

- Uncheck “Refund/Void through processor” – this allows you to record the refund in serviceminder without actually returning funds (because, in this case, no funds were ever received by you).

- The invoice status will revert to Open, enabling future payments.

Note: The Federal Reserve doesn’t notify the originating bank of a failing transaction, instead, the originating bank checks with the Federal Reserve daily to see if there are any returned transactions for them. Speak with your processor to see if they can set your account to receive ACH Returns notifications via email, per occurrence.

FAQs

How do I remove the ACH option for new invoices?

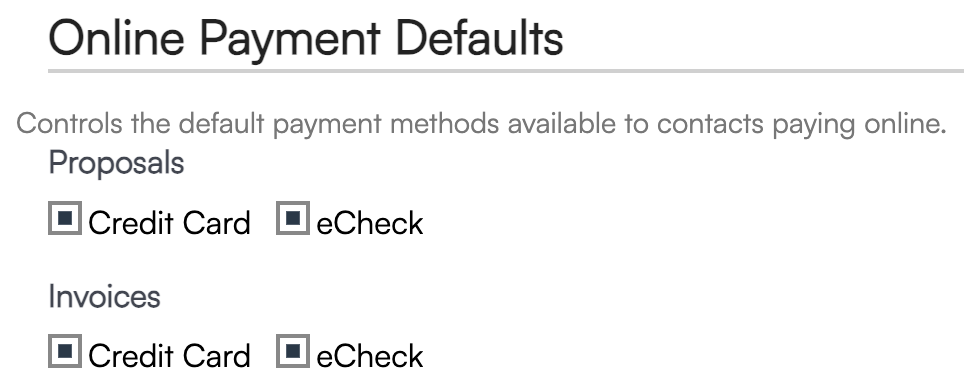

Go to Control Panel > integrations > Payments. Uncheck all boxes beside eCheck, the select save.

Will unchecking the ACH boxes remove ACH for current customers who already use it??

Yes, the option is not actually attached to the Invoice but is a configuration of how you set your account. If an Invoice has a balance and you make the change, when they go to pay again there will be no ACH option to select

Can I make credit card the default payment option instead of ACH?

There is no option to reconfigure the invoice/proposal so credit card is the first option instead of ACH.

Is ACH available in the customer portal and self-scheduler?

Yes, both eCheck and credit card are available payments for a customer who is using the online portal through serviceminder.

Can I disable credit card payments and make ACH the only option?

You would uncheck the Credit Card options in the Online Payment Defaults section in Control Panel > Integrations > Payments tab. This only applies to new invoices and proposals moving forward. For existing proposals or invoices you have to do it in settings on the individual proposal or invoice.

How do I refund an ACH payment??

Refunds for ACH/eCheck payments are handled differently depending on your payment processor. Some processors allow refunds within a certain timeframe, while others may require you to process refunds directly through their portal. Because the rules and timing vary, please check with your payment processor for the specific steps and requirements for ACH/eCheck refunds.

To learn more about declines and refunds in general, visit our Declines and Refunds help page.