Overview

This section discusses additional ways of paying multiple invoices for larger commercial clients. However, these are options that are possible to do for residential, single customers as well. Typically, these are only really utilized by brands with multi-property deals.

- An Overpayment on an invoice can be applied to other open invoices for that contact, all in one step. This can be done on individual invoices or in bulk.

- Many organizations work with commercial clients who won't (or don't like to) pay by individual invoices. For this situation, an organization may choose to send clients a Statement on Account - a list of all open invoices.

This article will review:

Applying Overpayment

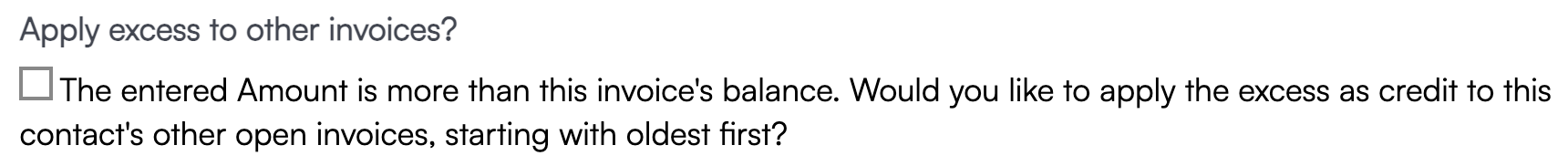

When recording an overpayment on an invoice, you will be prompted with the option to apply the excess balance to other invoices, starting with the oldest first.

Check that box to apply the payment. If there aren't any other open invoices, or if you don't check the box, the excess amount will be stored as a credit memo.

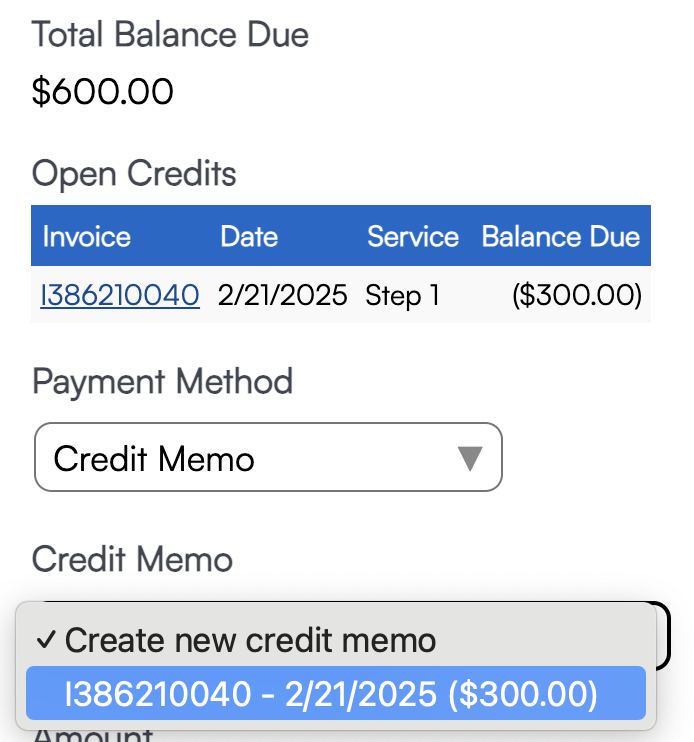

If you click on an open invoice, and select the Pay option, you will see any open credits that are available to use for that customer. Select Credit Memo as the Payment Method and choose the corresponding credit memo from the dropdown menu below.

Manage By Invoices

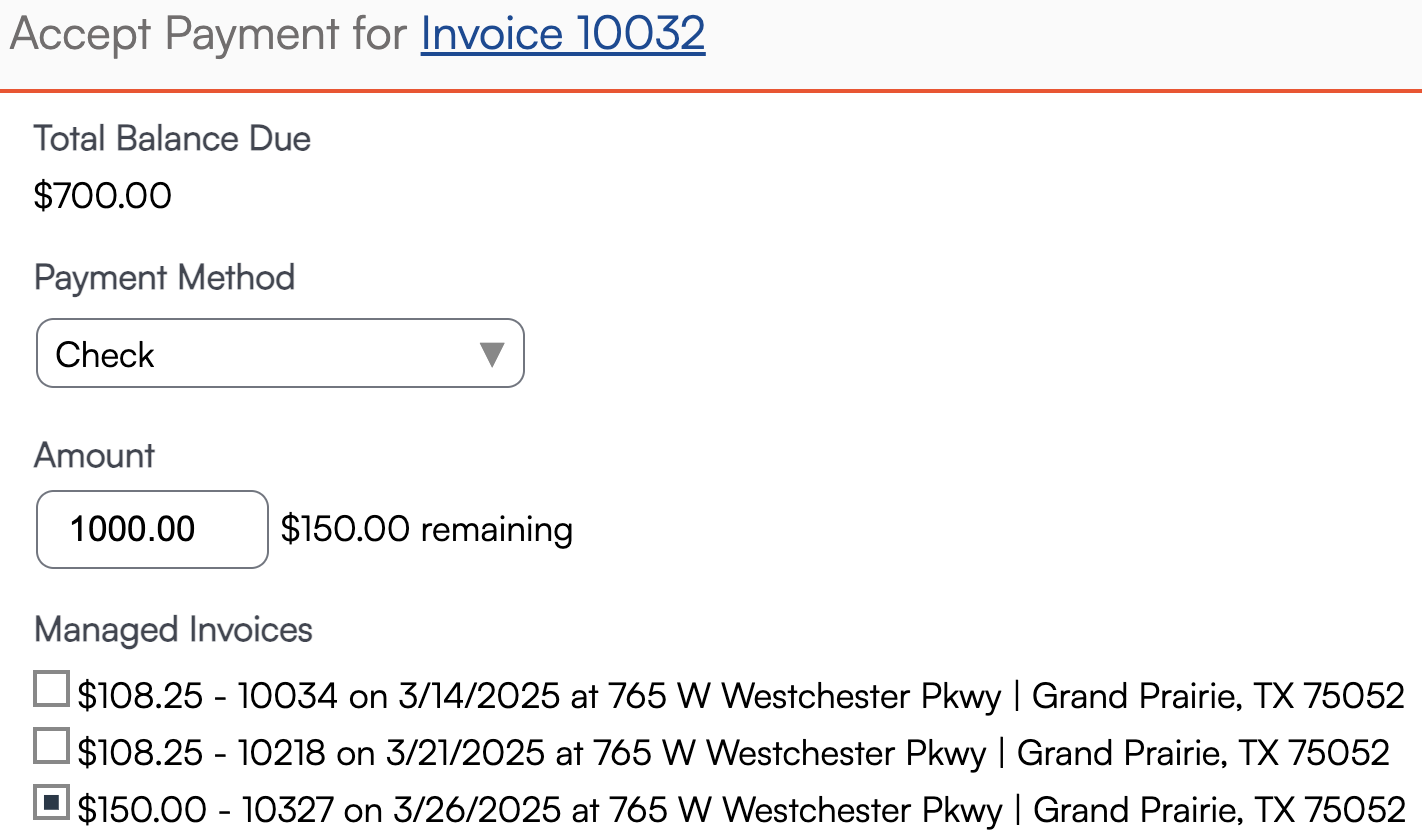

If a contact manages other contacts that have open invoices, overpayment via cash or check will show an option to select which Invoices to pay with the remaining amount.

Account Statements

In serviceminder, the "Statement" is behind the scenes, and is continuously updating for each customer. It's accessible in several ways:

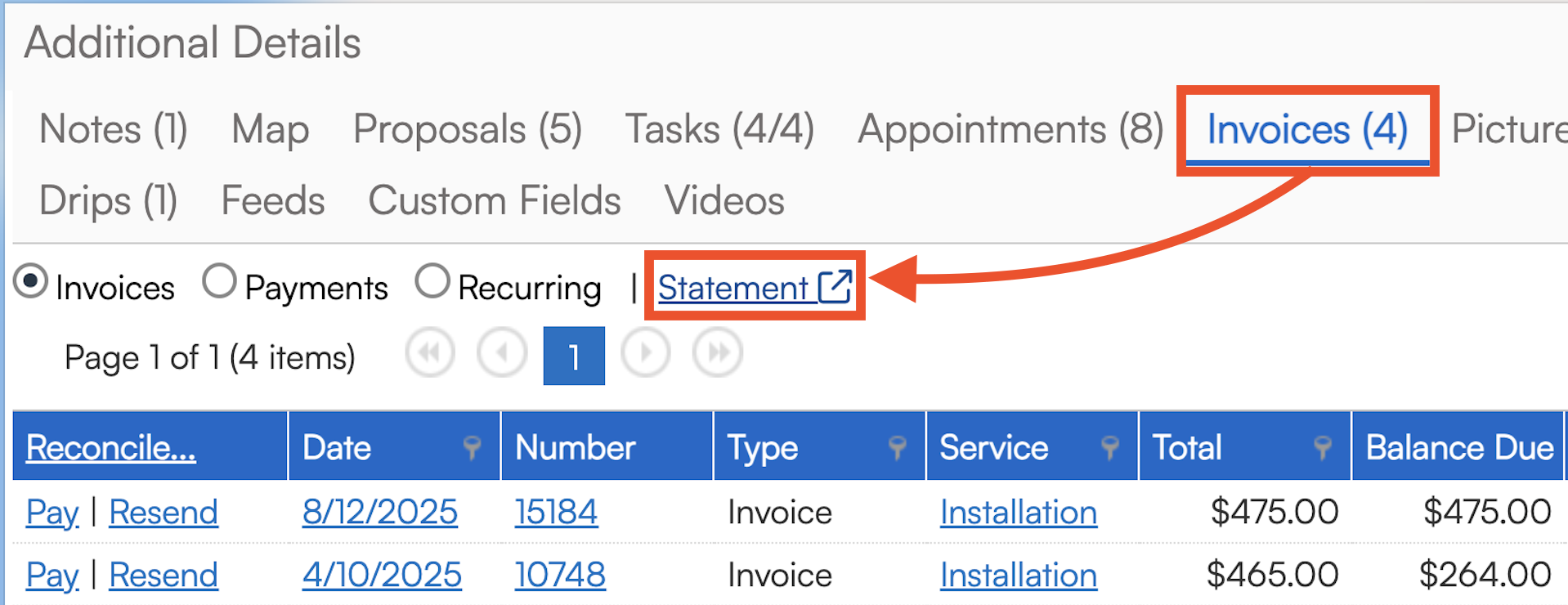

1. On the contact details page, under the Additional Details section, click the Invoices tab. From there, you will see a link to view the contact's account statement.

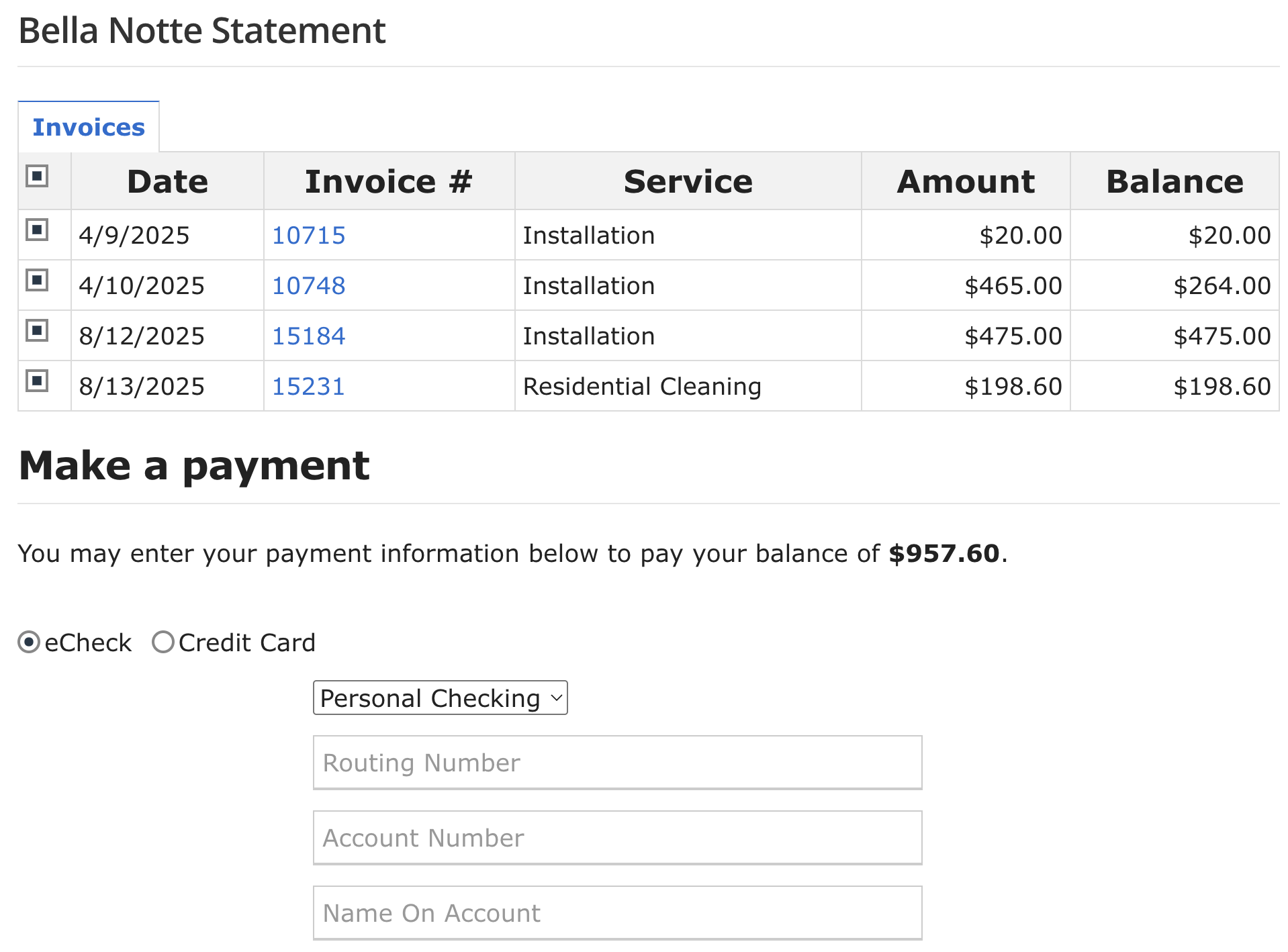

2. You can include the shortcode {contact.statement_url} in any communication with the contact. This will generate a custom link for them where they can review all invoices and choose to pay a portion of their total balance due.

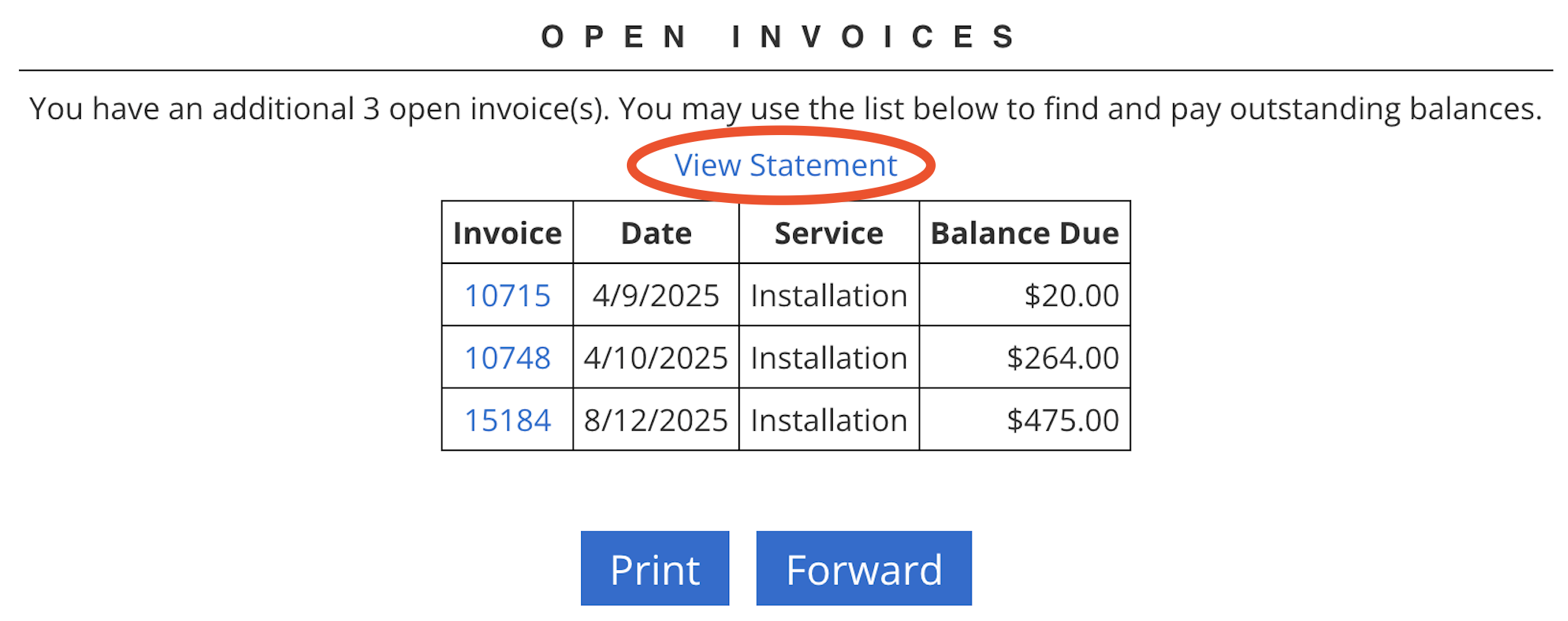

3. On any invoice, the customer may also find the statement view by clicking View Statement in the Open Invoices section.

FAQs

Can I use the Statement of Account to pay on behalf of a client?

No, the Statement of Account is an external feature. The customer must receive the statement and add their payment information to complete the payment.

Can the Statement of Account use ACH?

Yes, if your payment processor is set up to accept both ACH and credit card payments, you can process ACH payments via the Statement of Account.

What should I do if I accidentally entered the wrong amount when adding a payment to an invoice, and now I can’t write it off because the system thinks the invoice is paid in full?

For example, if an invoice for $500 has an overpayment of $550, we recommend the following steps:

Delete the payment in ServiceMinder.

If applicable, delete the payment in QuickBooks Online (QBO).

Record the payment with the correct amount.

Write off the remaining balance (if the amount was entered incorrectly on the invoice).

Note: Make sure the reference number, note, and payment date on the new payment match the original payment details.

How do I control which open invoices a payment is applied to if the system automatically applies it to the oldest invoice?

You can manage this by:

Creating a Credit Memo for the overpayment. This allows you to apply the credit to the desired invoices, even if they are not in chronological order.

If a payment was made on an invoice but needs to be moved, go to the invoice, click on the payment, and use the "Move" button in the upper right to apply it to a different open invoice. For credit card payments, click the payment date to access a different screen with more options.

If you have unnecessary credit memos, delete them and create new ones to apply to the correct invoices. Credit memos can’t be moved like payments, but they can easily be deleted and recreated.

I accidentally overcharged a customer on an invoice, and now I see two payments listed at the top right but nothing about the deposit. What do I do?

The deposit may have been applied differently depending on the brand’s workflow. Typically, the deposit is applied as a payment once the invoice is approved or finalized. If the deposit was applied to an appointment first (before invoicing), it would then transfer to the invoice when the appointment is completed.

In this case, the deposit didn’t transfer because there was no balance due after the payment was made. To fix this, you can refund the unnecessary payment.