Overview

This article explains how to charge a customer a finance charge and/or a credit card surcharge (also called a credit card convenience fee) on an invoice.

- Finance Charge – A percentage-based fee added to an invoice when a customer is paying over time (installments) or is late in making a payment. This relates to extending credit to the customer, not their payment method.

- Credit Card Surcharge – An additional fee applied only when the customer chooses to pay with a credit card, intended to offset credit card processing costs.

Before you set up a credit card surcharge in our system, please review:

Your state and local surcharge laws

Your payment processor’s surcharge policies

As a best practice, consider incorporating additional costs into your overall pricing structure instead of charging separate fees.

This article will review:

Need to know how to add a discount and/or markup to your proposal or invoice? View our Discounts and Markups help page.

Setting Up a Finance Fee

A Finance Fee can be used if you allow a customer to pay over time in smaller installments or if a customer is late in making a payment. In this case, you are assuming the responsibility of collecting the total amount due.

If you would prefer that a financing company assume that responsibility, we support an integration with Wisetack.

To set up a finance fee, follow these steps:

1. Create a Part by going to Control Panel > Parts & Add-Ons > Add. Name it something like Finance Charge so you can easily identify it.

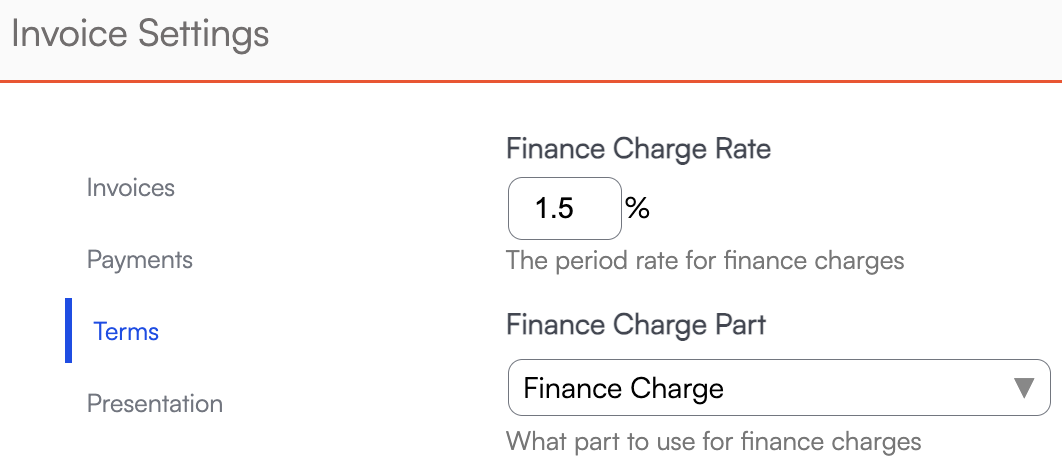

2. Go to Control Panel > Invoices. Scroll to the Terms section. Fill in the Finance Charge Rate (percentage) and select the Part you created from the Parts drop-down list.

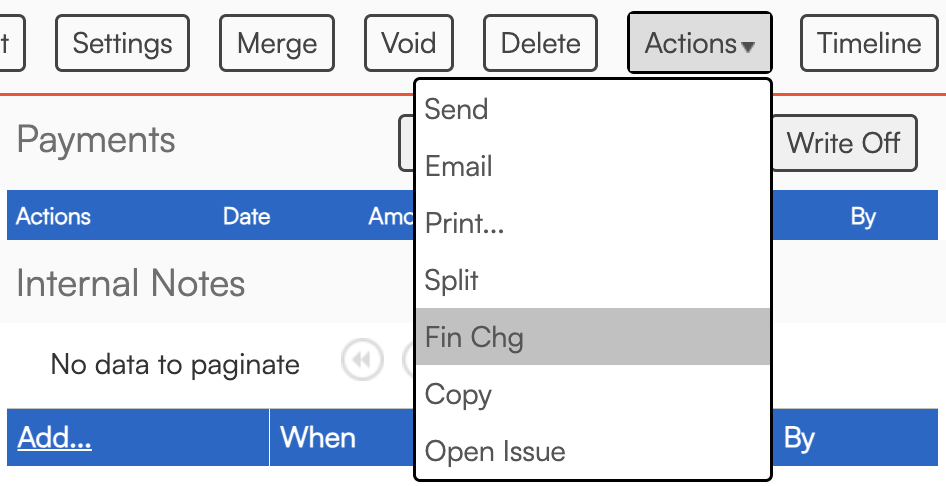

3. Once set up, when you view an open invoice, you will see a new option in the Actions menu: "Fin Chg." Click it and confirm Yes at the prompt. The appropriate finance charge will be added to the invoice.

Bulk Finance Fee

To apply finance charges to multiple invoices at once:

Use the Invoices Grid to filter to the invoices you want.

Go to Actions > Apply Finance Charge.

Confirm before the charges are added.

This will not automatically resend invoices. The next time they are sent (manually or via invoice reminders) the finance charge will appear.

Automate the Finance Charge

You can also have serviceminder automatically apply a finance charge every month to any open invoice older than a certain number of days:

- Go to Control Panel > Invoices.

- In the Terms section, click Auto Apply Finance Charges.

- Set the Day of Month and Minimum Age to control when charges are applied.

- Click Save.

This will apply the finance charge on your chosen date to every invoice older than the specified age. As with bulk updating, invoices are not automatically sent to customers.

Credit Card Surcharges

A Credit Card Surcharge is an extra fee added only when a customer pays with a credit card. It is intended to offset credit card processing costs and does not apply to other payment types.

If you choose to use the surcharge feature, you need to review both your merchant account agreement, as well as any state or local regulations which may restrict or prohibit use of this feature. As a best practice, we generally recommend avoiding surcharges when possible, since they can create additional compliance and customer experience considerations.

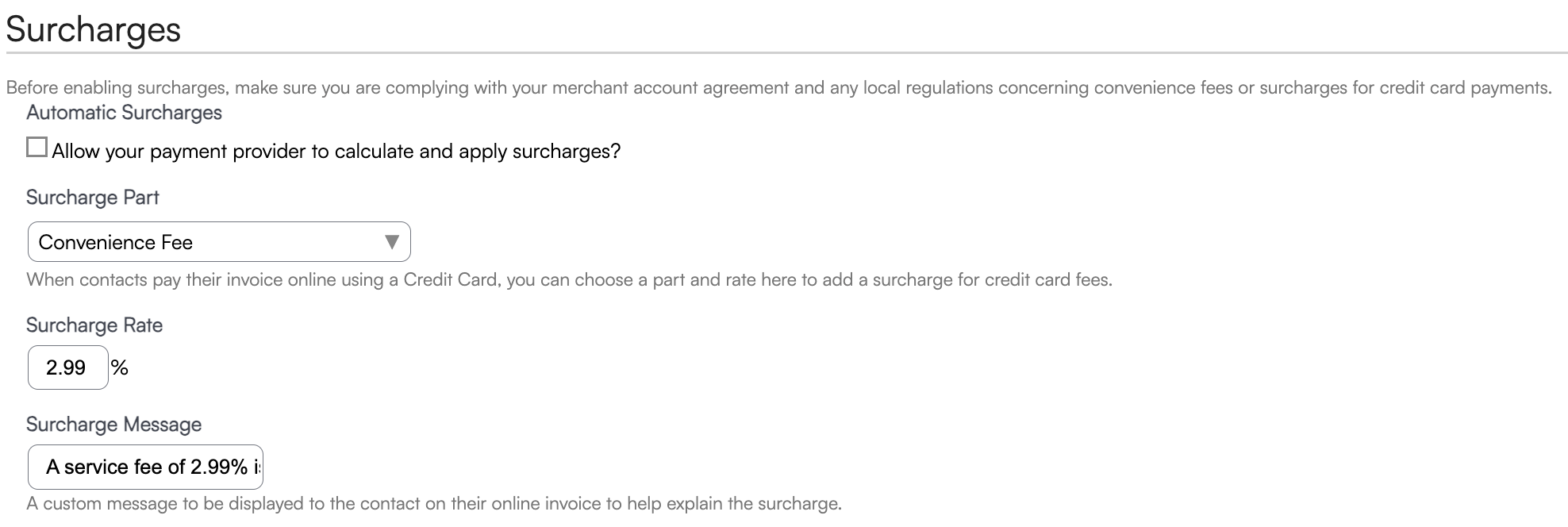

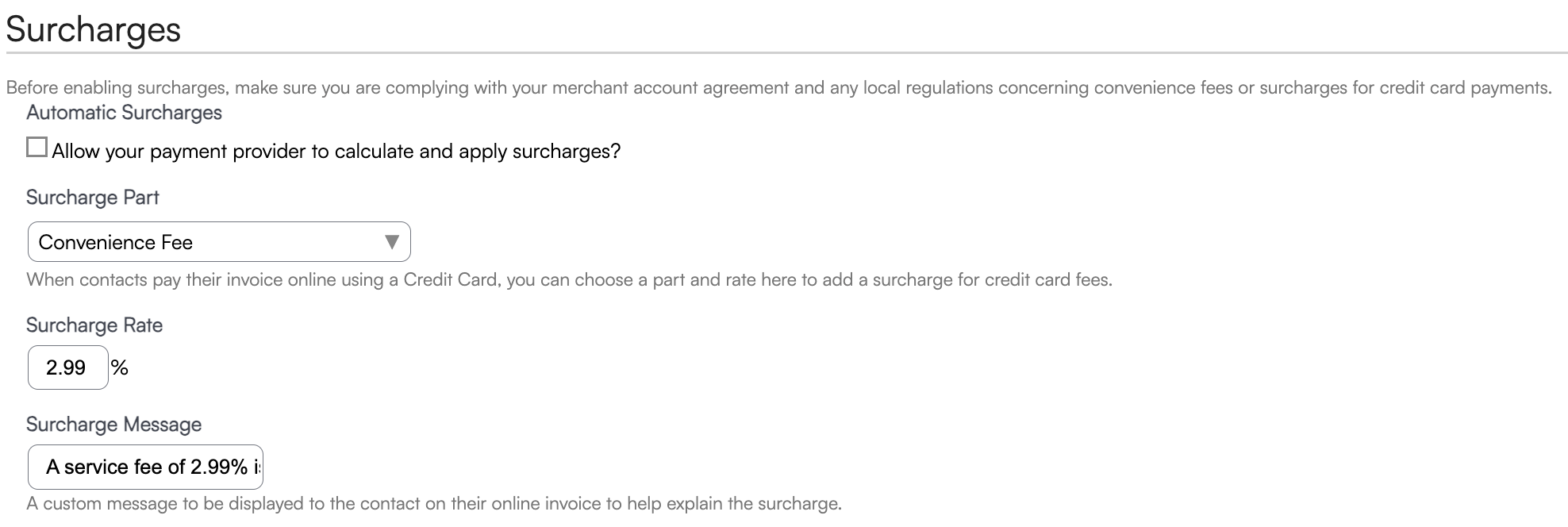

You must specify a Part for the surcharge and provide appropriate text describing it. This allows serviceminder to pull a compliant surcharging solution, which will appear on the customer’s receipt. The surcharge is only applied when the customer pays their invoice online with a credit card.

To set up a Credit Card Surcharge:

Create a Part for the surcharge: Control Panel > Parts & Add-Ons > Add.

Provide a name and description for the part. Some states and processors have strict naming rules.

Go to Control Panel > Integrations > Payments tab. Scroll to the Surcharge section.

Enter the Surcharge Rate and select the Part you created.

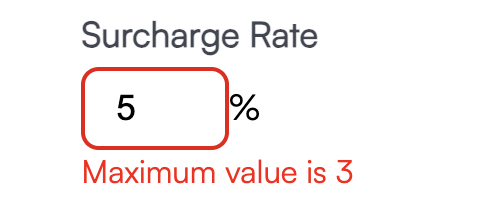

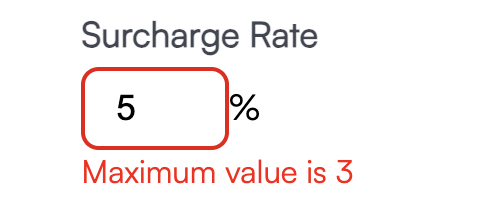

The maximum allowed in the U.S. is 3%. VISA and Mastercard also limit surcharges to 3%. The system will not allow a higher number.

Enter the surcharge message you want customers to see.

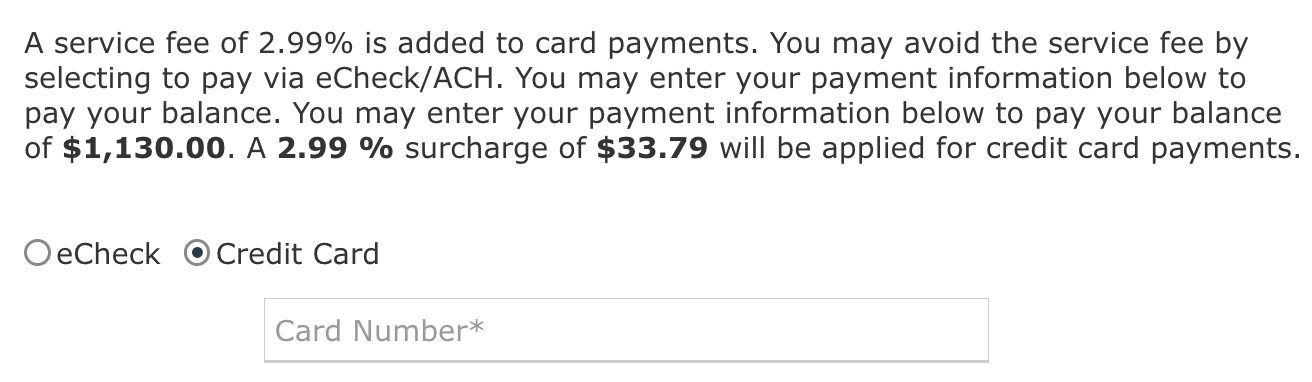

Once configured, the customer will see the message and surcharge amount when they select Credit Card as their payment method.

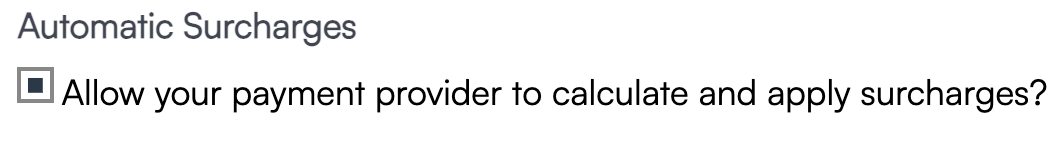

If you use ServiceMinder Pay as your payment processor, you will see the option to enable Automatic Surcharges when setting up the payment integration. We also have official surcharge integrations with Heartland, Payment Pilot, and Stax.

When this checkbox is enabled, the payment providers calculate and apply the surcharge themselves.

For answers to specific questions about the surcharge calculations and placement, please speak directly with your payment processor.

FAQs

With a surcharge in the integrations side, does the surcharge revenue get included in the end-of-month royalty report?

It depends on your brand revenue category setup. By default, it will be included because most categories are set at the service level. If you don’t want it included, create a category like Revenue Exclude and assign the surcharge Part to it.

Does it matter if I call it a “convenience fee” or “surcharge”?

ServiceMinder is agnostic on naming. Check your merchant account agreement and state laws for what’s allowed.

Can surcharges be added to deposits on a proposal?

Yes—only if using an official surcharge program. Otherwise, surcharges only apply to invoices, not deposits.

How can surcharges be applied to all payments?

Heartland, Payment Pilot, and Stax apply a surcharge to all online credit card payments.

Are debit cards charged surcharges?

No. In the U.S., surcharges can only be applied to credit card purchases and only under certain conditions.

Where can I see the surcharge on the invoice?

You won’t see it internally. To view as a customer: open an invoice, click Copy Link, paste it into a browser, and choose Credit Card. The surcharge will display there.