Overview

Managing how and when your customers pay is a crucial part of running a smooth operation in serviceminder. This article provides an overview of the different tools available to help you streamline payments, including Payment Methods, Payment Plans (installments), and Recurring Billing. You'll learn how to configure each option, when to use them, and how they differ - all from one central location in your account settings. Whether you're looking to offer flexible payment schedules, automate recurring charges, or simply record payments more accurately, this guide will walk you through everything you need to know.

This article will review:

What's the difference between Payment Plans and Payment Methods and Recurring Billing?

- Payment Methods are the ways you accept money from your customers.

- Payment Plans allow you to give your customers option to pay over time. Installments are specifically about the amount of payments made towards the balance of a service.

- Recurring Billing is also a pay over time method, but attached more specifically to subscription services. Subscription-style services are used for cases where you want to schedule a (typically) fixed length service offering where the appointments are distributed over a series of visits.

Settings and Navigation

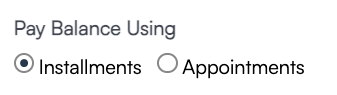

You can create both Payment Plans and Payment Methods on the same page within serviceminder.

Go to Control Panel > Payment Options.

Adding Payment Methods

ServiceMinder provides two payment methods by default: cash and check. Credit Card processing is set up separately.

If you accept other forms of payment like Venmo, PayPal, or Google Pay, you can set those up on the Payment Options page by clicking Add under the Payment Plans section.

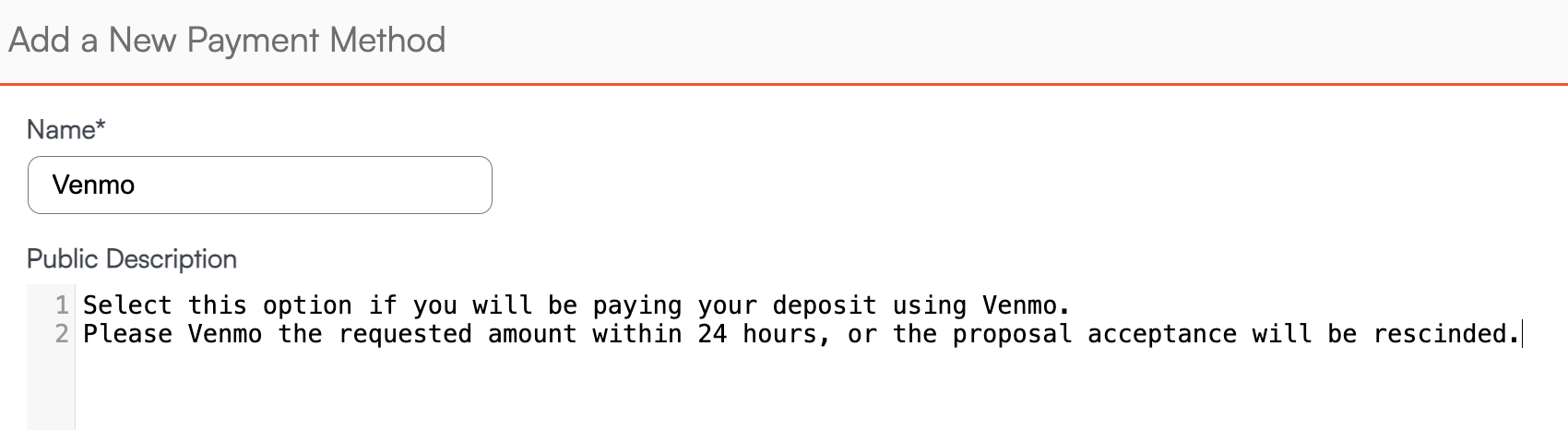

First, you need to give this payment method a name and description. This description will display to the customer if you choose to offer it as an option upon proposal acceptance.

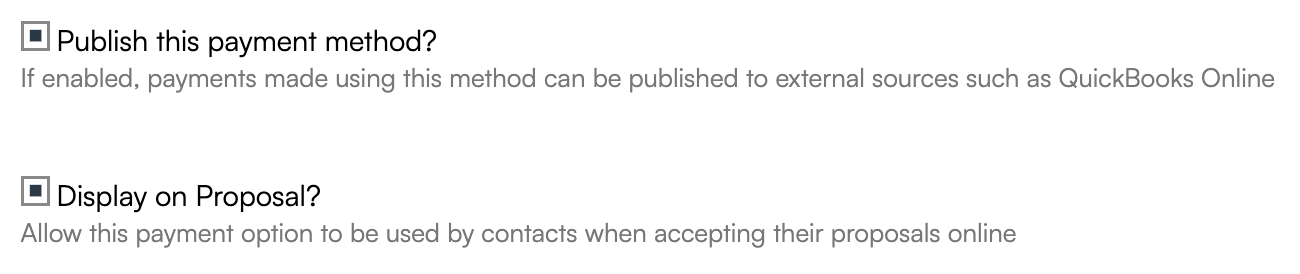

At the bottom of the page, there are two checkboxes that give you the option to publish the payment to QuickBooks and offer this payment method for customers paying a deposit on their proposal*.

*These alternate payment methods are just for recording payments you have already received on an invoice. "I got paid, now I need the invoice to show I got paid". If you offer an alternate payment method on the proposal, it will be recorded, but not be collected, in serviceminder. The customer will still have to pay you with their chosen method outside of our system.

If you choose to offer one or more alternate payment methods on proposals, customers will see each option next to eCheck and Credit Card.

Payment Plans (Installment Plans)

Payment Plans allow you to split a customer's total into equal, automated payments over a defined schedule. Once created, a payment plan can be:

-

Offered during the proposal acceptance process

-

Applied to an existing invoice

When a payment plan is attached to a contact, installment payments will run automatically based on the plan's schedule.

Creating a Payment Plan:

To create a simple two-payment plan (50% up front, 50% in one month):

- Go to Control Panel > Payment Options.

- Under the Payment Plans section, click Add.

- Enter a name for the payment plan.

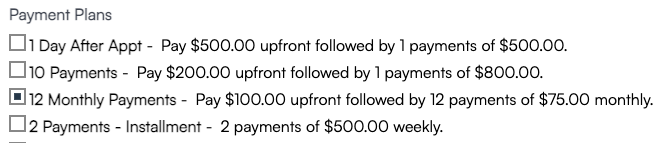

- (Optional) Check Auto Include on Proposals if you want this plan to appear automatically on customer proposals.

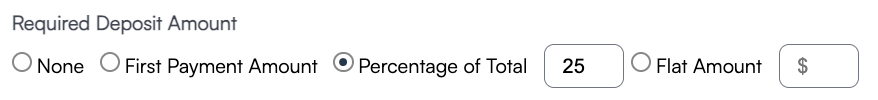

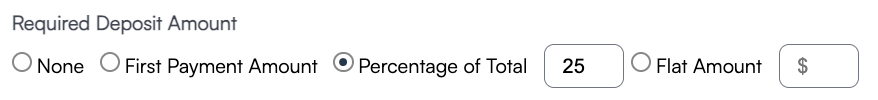

- Choose to set a required deposit amount based on the first payment amount, a percentage of the total, or a flat amount.

- Set the payments to run based on equally spaced installments or based on appointments.

- You can also choose to restrict this plan to specific service types if needed.

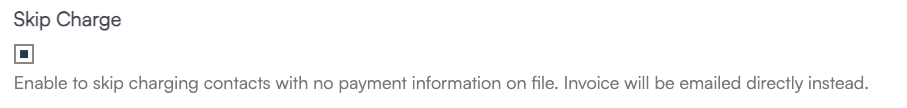

- If you don't want the credit card on file to be automatically charged, you can check the box to Skip Payment. This will result in an invoice being automatically emailed on the date of payment instead.

Adding Installment Plan

On a proposal, you can Edit and have the option to add one or multiple plans, don't forget to click Save.

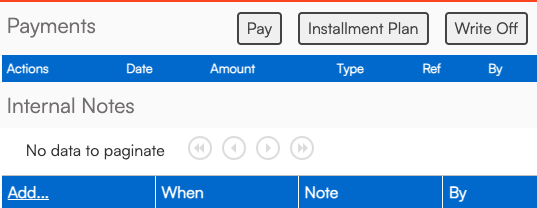

To add to an invoice, open the selected invoice. In the top right corner click the Installment Plan button. Select option best for the account, select payment method, enter date payment should begin, then enter card information, and Save.

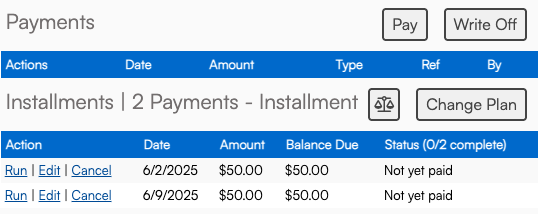

On an invoice, you can even Change the plan once its been added.

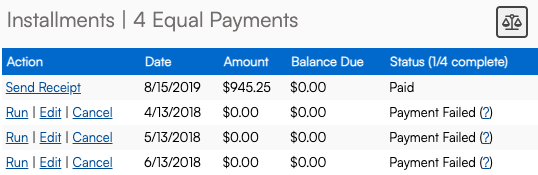

Notice in the image above showing the Payment Failed (?) allows you to click the question mark to learn details about why the payment failed.

Clicking on the Balancing Scale icon will allow you to update the balance to show new invoices with a balance due.

Recurring Billing

Recurring Billing lets you automatically create invoices for ongoing or subscription-based services — separate from job completion or Auto-Pay. It’s ideal for memberships, seasonal plans, or service bundles billed on a schedule.

Use Recurring Billing when:

- You want predictable revenue cycles (e.g., “bill every 1st of the month”).

- Services aren’t tied to individual job completions.

- You need to pre-bill or post-bill customers regularly.

Create a Recurring Billing Template

In Control Panel > Recurring Billing, you can create templates that define billing schedules for one or more services. Templates let you manage billing frequency, invoice type, and charge behavior in one place.

Important Settings

| Setting | Description |

|---|---|

| Frequency | The interval at which this billing plan runs (e.g., monthly, quarterly, annually). |

| Type | Defines how the payment appears on the contact’s record:

|

| Amount | The dollar amount charged on each occurrence of the plan. |

| Quantity | Used only when your Invoice Mode for this service is set to Accumulate (for subscription-style credit tracking). Leave blank otherwise. |

| Skip Charge | If checked, the system will not automatically charge the card on file. Instead, an invoice will be sent to the contact. |

| Send Invoice | Works only if Skip Charge is ON. If both Skip Charge and Send Invoice are checked, the system automatically emails the invoice to the customer for manual payment. |

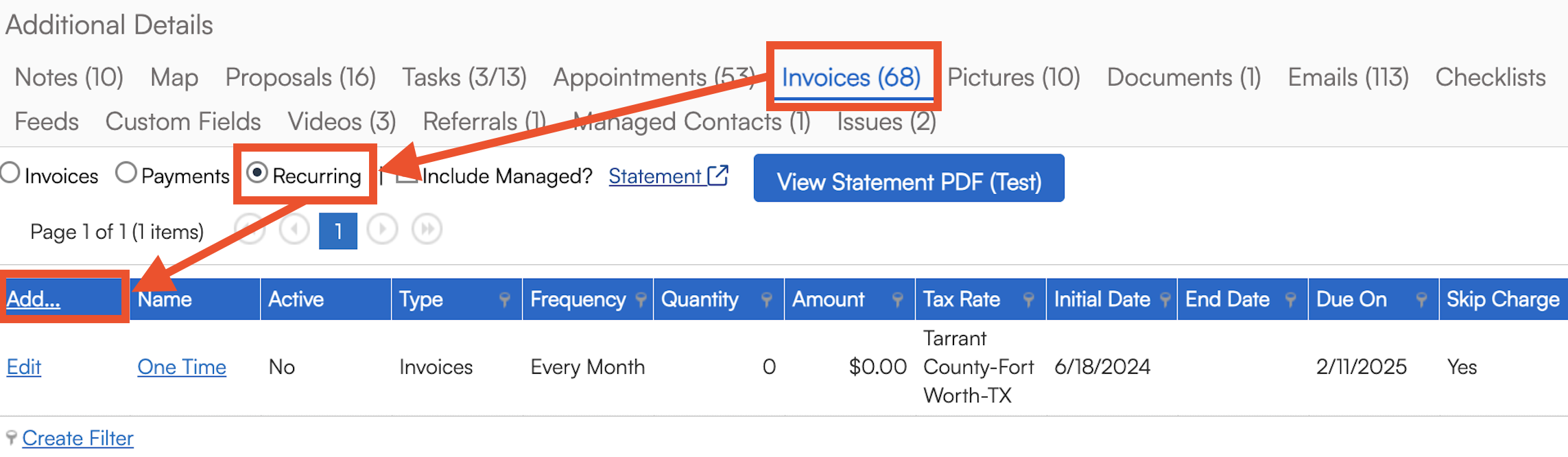

Add or Review Recurring Billing Plans on a Contact

To see active or historical billing plans for a customer:

- Open the Contact Details page.

- In the Additional Details section, go to the Invoices tab.

- Select Recurring to view all current and past billing plans.

4. Click Add if you want to add a billing plan directly to this customer's account.

- Use the Template dropdown menu to choose a template that you've previously created.

- Fill in the information manually to create a custom billing plan.

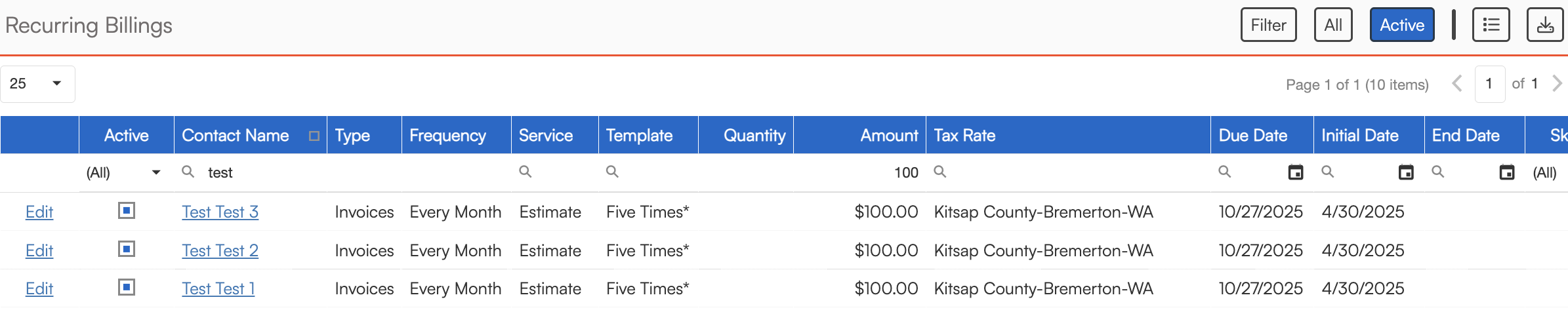

You can also review all active Recurring Billing plans via the Recurring Billings tab in the Snapshots section of the navigation menu.

End a Recurring Billing Plan

You can end a plan from either the contact’s record or the Recurring Billings grid.

- Click Edit next to the plan you want to end.

- Choose one of the following:

- Uncheck Active to end the plan immediately, or

- Enter an End Date to let the plan run until that date.

Once inactive, no new invoices will be generated for that plan.

Common Uses

-

Maintenance Plans: Offer annual or semi-annual service contracts billed monthly to make payments more manageable.

-

Subscription Credits: Use “Deposit” type billing to prepay for a set number of future visits or service credits.

-

Prepaid Packages: Bill clients upfront and apply credits automatically as jobs are completed.

Payment Reporting

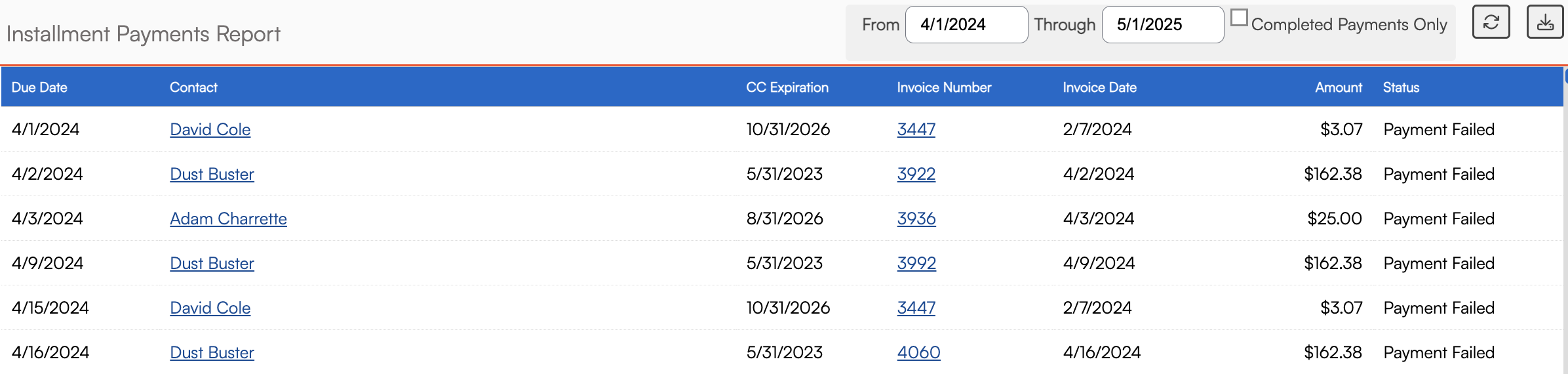

Automated pay options also include Installment Payments. The Installment Payments Report tabulates data regarding customers' payments made as part of a plan. Each month containing payments is displayed and expandable to reveal all payments on each invoice by customer.

FAQs

Are there any other ways of consolidating payments in ServiceMinder?

You can send Statements to customers, this is usually only done for Commercial clients. You can find this on the Contact Details page.

Another option if you have several invoices generated for a single customer is to Merge them into one. You can choose to keep duplicate line items separate or combine them when you are choosing Merge settings.

The third option is to go to Control Panel > Invoices and setup consolidated payments if you use auto pay. You can choose to email an invoice or not and what day or timeframe do you want to run those payments. \

Can I put multiple installment deposit payments on a single proposal?

Is there a way to have a payment plan start when the proposal is accepted?

There is no way to have a multiple payments added to the proposal unless internally added as an additional deposit. There is no way capture payments made unless you are just adding a note to the customers account. The Invoice is the method used to capture and track the payments made. We have no pre invoice method of tracking payments made that is not considered a deposit. And the nature of installments creates an Invoice for payment.

If I set up a recurring billing for example a year and break up the payment by 12 so they are paying a monthly amount for all services that year. Every time I complete there appointment (we schedule multiple appointments off of different parts of the proposal) is it going to invoice for that appointment or just go off the Recurring Billing I set up?

There are a few ways you can go about this.

If you are going to use Recurring Billing then you need to zero out the pricing on the appointments. If there is pricing on an appt it will generate an invoice, so you can schedule things like they are and then just have no pricing on the appts so that the recurring billing will take care of it.

Alternate option - use a payment plan. Invoice the proposal and apply a 12-month payment plan. But when scheduling like you are, you'll still want to make sure the appts don't have pricing.

Last option is to schedule the appts and let SM generate the invoice. You could try out consolidated billing along with that. The payment wouldn't be the same amount each month though, it would depend on what appointments fell within that timeframe.

I'm running into an issue with accounts that have chosen a payment plan, and upon approving the invoice (despite the "payment plan" drop down box is chosen), all payments are being processed at once after that approval.

The payment method is being selected when approving/saving the invoice. If that information is entered there then that amount will be charged instantaneously. This field pictured below is not required when Approving an invoice. It appears when editing/approving an invoice.

I need to move a payment, but can't. I assume it is something to do with being an installment payment. How can we get that payment from invoice A to invoice B? Can we accomplish that without refunding the payment?

Installment payments can't be moved like regular payments. I think the best thing to do is to create a credit memo for the payment amount, put in the reference info for the CC payment, and apply that to the new invoice. Then on the old invoice, you'll refund the payment, but uncheck the box to refund it to the processor (you don't want to actually refund it, but only mark it as refunded in SM.)